January Supply Chain Update

SUPPLY CHAIN, PRICING, PRODUCT UPDATES:

Happy New Year!

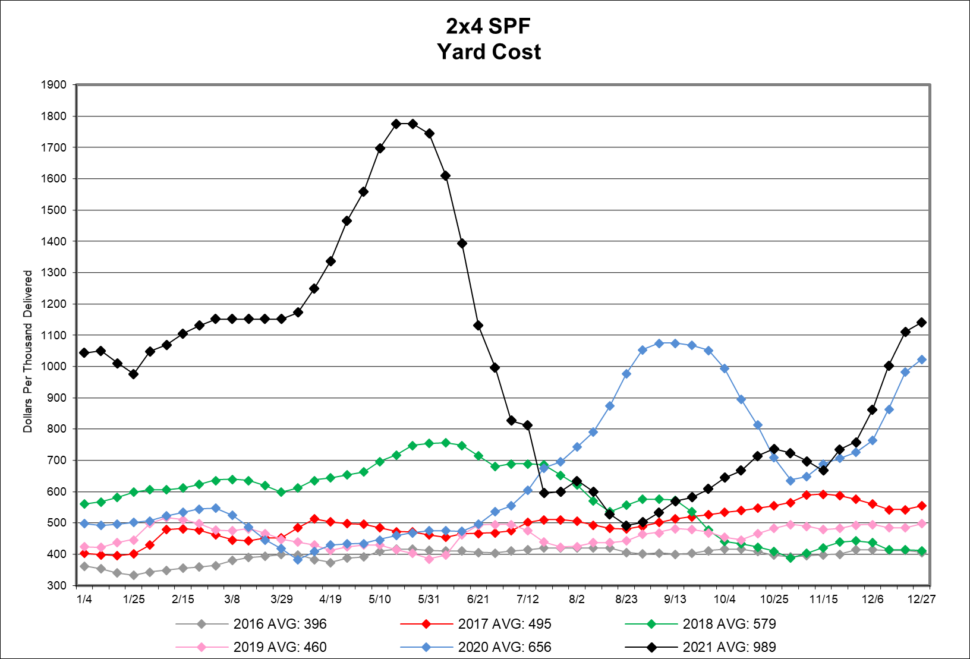

We begin 2022 with lumber and panel markets like those we experienced in the 2nd quarter of 2021. Lumber increased 40% in December alone. Futures prices are up marginally from these levels at year-end. Note that price levels are tracking about 20% higher than this same point last year.

As we shared in our mid-month December update, November flooding in British Columbia was the primary impetus that sent the lumber market climbing. An environmental policy restricting harvesting in BC and new US tariffs are also in play. Steady to strong demand is frankly the key variable. As prices began to spike, dealers and their builders seeking to protect projects were making purchase commitments.

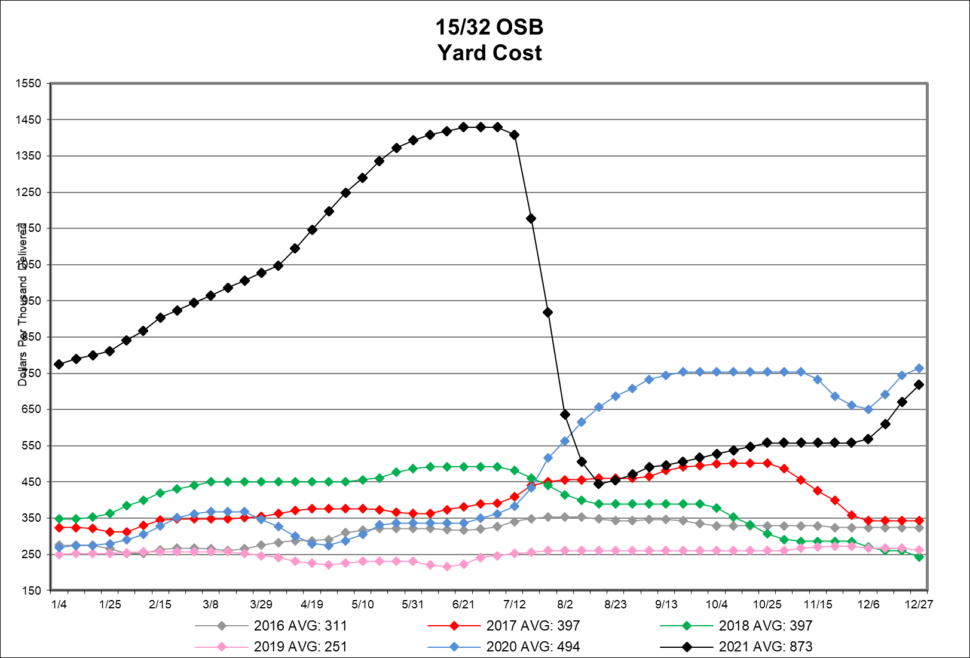

OSB pricing was increasing at a slower pace until December. In December alone, OSB prices have increased 30%. Panel availability entering 2022 is tight, for both OSB and Plywood.

Additionally, prices for many other building materials are increasing in the new year. Marvin and Andersen, for example, are each increasing prices 7-10% as we begin 2022. Therma-Tru announced price increase for February in excess of 20%. See below for a detailed update of price increases/lead times by product line.

So, we begin 2022 with strong demand for new homes and remodeling, a supply chain that is presently positioned to support most, but not all this demand, plus a dramatic spike in new Covid cases. I came across a Forbes article, which provides “micro-housing market forecasts” for 2022, authored by many economists and industry professionals. Click HERE to view.

A few observations I pulled from this article follow:

- New homes sales are expected to increase 5-8% over 2021.

- Mortgage rates are expected to increase modestly throughout 2022 to reach 3.6% by year-end.

- With wealth gains for homeowners due to rising home values, the remodeling sector will realize strong growth in 2022 as homeowners seek to add space, improve energy efficiency, and increase resiliency of an aging existing housing stock.

- Supply chain issues and labor shortages will continue to limit overall growth.

- Demographic factors, like hybrid work from home/office and the way millennials seek to buy, will influence project design and how we need to adapt our sales models.

- Price growth is referenced infrequently. Pricing is not anticipated to grow as it did in 2021. It will be interesting to see how inflation influences this.

As I believe we concluded in several of our prior monthly updates, we do not have any clarity on when the price volatility and supply chain issues will lesson, but we’ve learned to work together to adapt to this new normal. Please remain in touch with our sales professionals regarding your projects. We update them weekly on market changes.

Thanks for your partnership,

Regards, Bob Wood, President

P: 717-792-2500 | E: [email protected]

CABINETS:

- Gallery lead times have extended to 10-15 weeks.

- Omega / Dynasty lead times have extended to 18-20 weeks.

- Legacy lead times have extended to 7-8 weeks.

- Timberlake lead times have extended to 12-14 weeks.

- Quality Cabinets lead times have extended to 9-10 weeks.

- Aristokraft lead times have extended to 16-20 weeks and announced a price increase of 17% effective January 7th.

- WOLF Cabinetry lead times have extended to 6-8 weeks. There will be a 13% price increase on their Signature Series effective January 7th.

DECKING & ACCESSORIES:

- Trex has announced a price increase to go into effect in January. The amount of increase has yet to be shared. We will update this report with additional details once we receive more information from the manufacturer.

MILLWORK:

- Fypon has announced a 7% price increase effective February 7th.

- BWI / Masonite have announced the following price increases effective January 12th, as well as product discontinuations. Click HERE for additional details.

- Flush Interior Doors: 21%

- Molded Hollow Core Interior Doors: 13%

- Molded Solid Core Interior Doors: 8%

- Stile & Rail Doors: 11%

- HB&G has announced a price increase that will go into effect on Monday January 3rd.

- Aluminum: 15%

- Balustrade: 15%

- FRP Pergola: 25%

- PermaPost, Wraps, Columns: 3-25%

- Wood Columns: 10-25%

- Armstrong Ceilings has announced a price increase of 10% that will go in effect January 31st on all acoustical and drywall suspension systems.

WINDOWS & DOORS:

- Andersen Window lead times on 100 Series is 12-13 weeks, 200 Series is 6-7 weeks, 400 Series is 8-16 weeks, A-Series is 13-14 weeks and E-Series 14-15 weeks. Patio door lead times on 100 Series is 18 weeks, 200 Series is 7-14 weeks, and folding doors are 20-21 weeks. They have also announced a price increase of 7-10% that will go into effect on February 10th.

- Marvin Windows and Doors lead times on Elevate Collection is 15-16 weeks, Essential Collection is 15 weeks, Signature Collection is 17-18 weeks. They also announced a price increase, effective December 17th, of 7% on Signature, Skycove, Essential & Elevate.

- Ply Gem continues to have extended lead times. 1500 Series Single Hung is 24 weeks, and the Pro Classic Double Hung is 15 weeks.

- Simonton’s lead time is 16 weeks on the new construction series and 8-10 weeks on the replacement series. Due to the extreme cost increases related to Krypton gas supply constraints there will be a 120% increase on Simonton’s Krypton gas option effective February 1st.

- Silver Line lead time is 12 weeks on single hung and 8 weeks on double hung.

- Atrium lead time is 12 weeks on new construction double hung, 30 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series.

- 7-D Windows lead times continue to be 3-4 weeks. Tempered glass units are 12 weeks. Contact your sales rep since these lead times enable a quick turn project.

- Therma-Tru has announced a price increase effective February 4th.

- Fiberglass Doors 16%-18%

- Steel Doors 18%-20%

- Composite Frames 20%-22%

- BWI / Masonite have announced the following price increases effective January 12th.

- Steel Exterior Doors & Frames: 12%

- Fiberglass Exterior Doors: 11%

- Decorative Glass Units: 14%

- Standard Glass Units: 10%

GARAGE DOORS:

Lead times are 16-20 weeks depending on style and color selection.

INSULATION:

Insulation continues to be on allocation and supply issues will more than likely continue into this year.

ROOFING:

- EPDM rubber roofing & accessories all have extended lead times, anywhere from 60-120 days depending on the product. Rubber roofing & accessories will have a 10-20% price increase February 1st.

- We are experiencing significant extended lead times, ranging from 45 to 75 days, on coil stock, roof edge, and flashing products.

- GAF’s supply and color availability continue to be very limited. They have announced a price increase of 6-8% that will go into effect on January 31st.

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and the full line TAMKO Titan XT. They have announced a price increase of 8% that will go into effect on February 7th.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

SIDING:

- Berger continues to have extended lead times on all coil stock, flashing & roof edge.

- CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers sales rep for clarification on the availability of your color selection. All CertainTeed products are on allocation, and we are still experiencing extended lead times. We are currently out to January 20th with orders. Please click HERE to review a list of discontinued CertainTeed products.

- James Hardie has announced that all shingle siding is on allocation and also, they’ve permanently discontinued Reveal Panel Systems in both primed and ColorPlus Technology. Click HERE for additional details.

EWP:

LP is on allocation and is experiencing extended lead times of 3 to 4 weeks. Keep in contact with your sales rep for up-to-date information.

HARDWARE:

Since March 2020, steel prices have more than doubled due to raw material shortage and escalated shipping costs. We anticipate this continuing into 2022.

- Yale has announced a 7-10% price increase effective on January 1st.

- Schlage has announced a 7-10% price increase.