March 2023 Supply Chain Update

After two years of “having coffee” with you through our monthly economic update, I’m gratified to inform you that I have officially retired. Over the past 17 years, I’ve enjoyed working with our Myers team and vendors and have been fortunate to call many of you friends.

We’ve tackled one of the most severe housing recessions in history and pandemic influenced supply chain challenges. My relationships in this industry have been a blessing, so my transition is bittersweet. My wife, Cheryl, and I are looking forward to our new journey with the confidence that new opportunities to invest in people will surface.

On that note, it is my pleasure to introduce Roger Payne as the new President of Myers! In addition to his extensive industry experience, Roger has held leadership positions with 84 Lumber, BFS and ABC Supply.

He’s looking forward to traveling with our sales team and the opportunities to meet everyone. I’ve had the privilege to spend considerable time with him this month. Roger’s passion for our industry and care for people will complement the Myers team. You are in good hands!

To continue with my final update, Austen Hufford reported in the Wall Street Journal on February 15th that “The consumer roared back last month [in January] with a 3% increase in retail spending that was the largest monthly gain in nearly two years, adding to evidence that U.S. economic growth picked up at the start of the year. The seasonally adjusted jump in U.S. retail sales in January from December followed declines in the final two months of 2022 as shoppers spent more on vehicles, furniture, clothing and dining out.”

Mr. Hufford continued by sharing that “Job growth surged at the start of the year. Employers added more than half a million jobs in January, and the unemployment rate reached a 53-year low. Manufacturing output increased 1% in January, after dropping in the final two months of the year. High inflation also cooled slightly in January.”

With this backdrop, the Fed was quick to respond. They had already hiked rates a cumulative 425bps in 2022. The additional 25bps hike last month propelled the fed fund rate to a range of 4.5%, the highest since October 2007. The Federal Open Market Committee projections from December 2022 suggest the federal funds rate will hit a terminal rate of 5.1% in 2023, implying additional rate hikes this year.

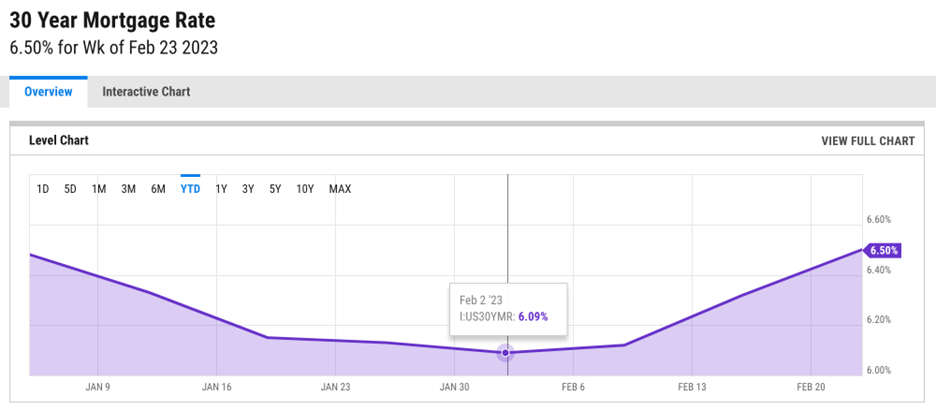

As you would expect, the financial markets retracted swiftly to the Fed’s continuing efforts to thwart inflation. The week of February 19th, the stock markets dropped several percent and mortgage rates have increased smartly. Last month, we shared that the 30-year mortgage rate had declined from 7% in the 4th quarter to 6.1% to start the month. This week’s rate rose to 6.5%. Look at the steepness of this week’s day over day trend. This large of an increase in such a short period of time is a big hit to affordability.

So, I’m perplexed to discern how this mortgage rate reversal will impact the nice uptick in new construction we experienced in January. With the turn of the year, builders experienced a sharp increase in lead activity and related improvement in sales by community from the 4th quarter. Interestingly, the new activity was for both entry level and custom homes. Lower mortgage rates and financial incentives aided this growth. Surveyed builders reported that incentives most used were covering closing costs, buy down of mortgage rates in early years and finally price reductions.

This uptick in new home sales prompted industry economists to boost their forecasts for SF construction in 2023 by a few percent to a level of 9 to 11% for the year. They also believe home prices will decline in the range of 10%. The northeast region, of which we are a part, has been the strongest performing region in the country. I wonder if the late February return to a recessionary tone will stifle the early year ramp up, we are enjoying, across the country.

Remodeling pace early in 2023 has also been resilient. Economists suggest that homeowners are more likely to remodel than move since most existing mortgages are sub 4%. Some suggest that we may experience a lull in discretionary remodeling until the economy is more settled. The forecasted decline for remodeling overall is only a few percent.

Myers quote activity volume for SF and MF projects is trending like early 2022. This is an uptick from quote request activity we experienced in the 4th quarter. The mild winter could be one of the reasons for this level of activity. We sense that our remodeling partners are also experiencing an increase in leads since the holidays.

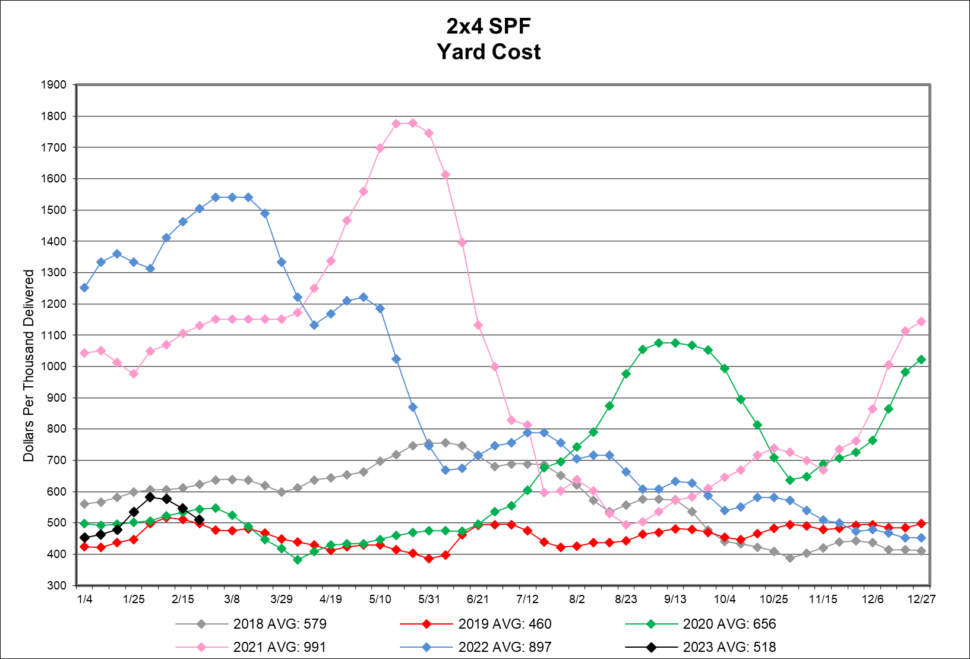

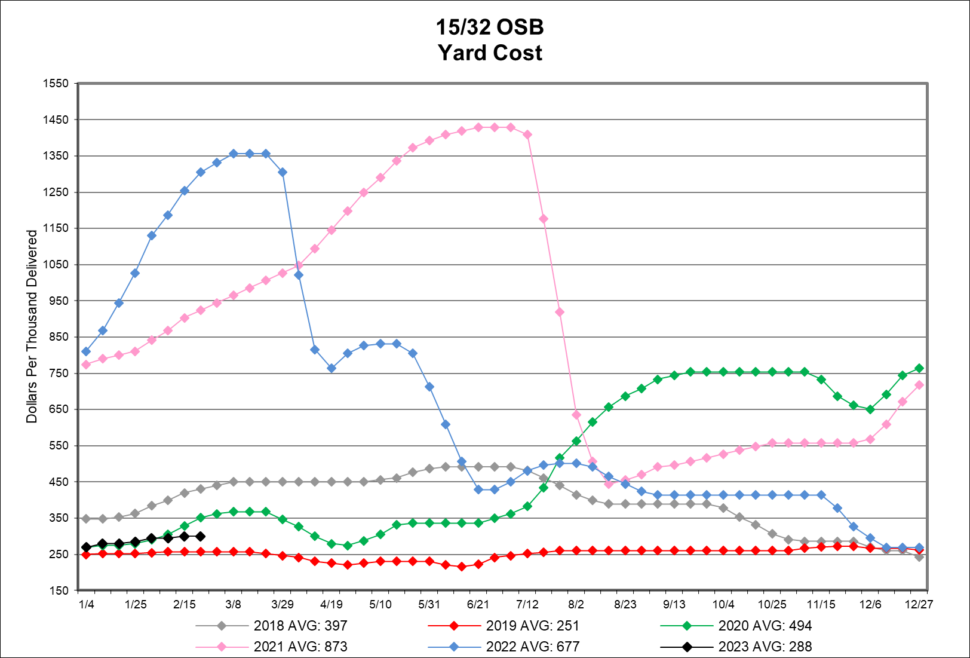

Lumber prices have decreased slightly in February, despite manufacturer curtailments and mill shutdowns. Panels are up approximately 3%, however this is low in comparison to this time last year.

In last month’s update, we provided several lead time changes for many product lines. Hardware pricing is softening due in part to the fact that container shipping prices have returned to historical levels. Economists believe we will experience a 4% decline in pricing in the aggregate this year. Please see a more detailed overview of price announcements and lead times below.

I’ve enjoyed the opportunity you’ve afforded me to engage with you in this forum. I’m excited about the intermediate to long term outlook for our market. The Myers team is enthusiastic to help you achieve your goals.

Blessings,

Bob Wood

—

CABINETS:

- Gallery lead times are currently 4-6 weeks.

- Omega / Dynasty lead times are currently 7-10 weeks for framed & inset cabinetry.

- Legacy lead times are 4-6 weeks.

- Timberlake lead times are 4-6 weeks.

- Quality Cabinets lead times are 2-4 weeks. Quality Woodstar lead times are 12-13 weeks.

- Aristokraft lead times are 2-4 weeks.

- WOLF Cabinetry lead time is 1-6 weeks.

WINDOWS & DOORS:

- Andersen Windows & Doors lead times on 100 Series are 3-5 weeks, 200 Series are 2-4 weeks, 400 Series are 2-13 weeks, A-Series are 10-12 weeks, E-Series are 13-15 weeks, MultiGlide are 12-14 weeks, and folding doors are 19-21 weeks. Assembled patio doors have extended lead times as well.

- Marvin Windows & Doors lead times on the Elevate Collection is 10-11 weeks, Essential Collection is 6-7 weeks, and Signature Collection is 18-24 weeks.

- Ply Gem lead times are 6 weeks for 1500 Series Single Hung and 5 weeks for Pro Classic Double Hung. As of January 30th, Ply Gem will begin taking orders again for extruded black exterior for all 1500 Series vinyl collection window and doors.

- Simonton’s lead time is 3-4 weeks on the new construction series and 3-4 weeks on the replacement series.

- Silver Line lead time is 3-4 weeks on single hung and 2-3 weeks on double hung. Black & bronze color coated are an additional 3-4 weeks out.

- Atrium lead time is 2 weeks on new construction double hung, 2 weeks on new construction single hung 150/160 Series, 7 weeks for black laminate and 4 weeks on SH 130 Series.

- 7-D Windows lead time continue to be 2 weeks. Tempered glass units are 3 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

GARAGE DOORS:

- Lead times are 4-6 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue throughout the year.

SIDING:

- Myers is currently taking orders for March 16th on CertainTeed siding deliveries.

CAULKING & ADHESIVE:

- Caulking & adhesive continues to be hard to locate. We’ve been experiencing longer lead times on construction adhesive. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain.

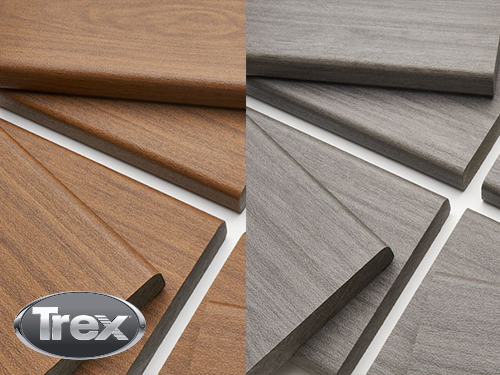

CHECK OUT TREX’S NEW LUXURY

DECKING COLLECTION – SIGNATURE!

• Available in 2 earthy, neutral colors inspired by nature – Whidbey & Ocracoke

• Sophisticated grain pattern

• High-performance shell: fade, stain, scratch & mold-resistance

• 95% reclaimed wood and plastic film

• 50-year Limited Residential and Fade & Stain warranties

• Available in grooved-edge boards or square-edge boards

• Crafted in the USA

Click HERE to learn more and contact your sales rep to see it in person.

ONE OF THE BEST JUST

GOT BETTER WITH DESIGNER-CENTRIC STYLES.

Timberlake has expanded their product offering with a variety of new finishes, cabinet sizes, hardware and range hoods – creating a more modern finish palette & providing the decorative flourishes that are in demand!

• 4 New finishes: Maple Latte, Painted Vanilla, Painted Biscotti Glaze, Painted Black

• Expanding SKU selection of various cabinet sizes

• Expansion of popular hardware finishes, including Modern Brushed Gold, Matte Black & Brushed Copper

• Modernized range hood additions with styles that homeowners want

Interested? Check it out HERE.

THERMA-TRU IS BRINGING IT WITH

THEIR LINEUP OF NEW PRODUCTS!

Today’s homes blur the lines between modern, casual and traditional styles as each design borrows elements from the others. Their new products reflect that with bold, simple, and elegant options for every home.

Check out their new collections, glass options, sizes & configurations, finishes and more HERE.

Click HERE for the full details about these great product additions!