January 2023 Supply Chain Update

I appreciated the opportunity to chat with many of you at our customer Christmas get-togethers. Countless discussions were focused on what is happening in the housing market. It was encouraging for me to get affirmation that the Central Pennsylvania market, especially along the 81 corridor, is performing better than other markets across the country. I sensed lead activity is pacing slower than the pandemic spurred levels but remains reasonable.

Interestingly, the aggregate themes shared regarding SF new construction reflect what I’ve been learning from economists: 1) the high-end custom market demand is good even though it has softened from pandemic levels, 2) the move up home market is mixed, some of your customers are waiting to discern a start date (nervous about the depth/length of a recession) and others are forging ahead due to cost reductions from lumber/panels and the decline in mortgage rates into the low 6% range, and 3) the entry level market is pacing the slowest from pandemic levels but remains active due to incentives (especially financing incentives), home design changes to lower costs and home availability. Affordability is a bigger factor for the entry level segment.

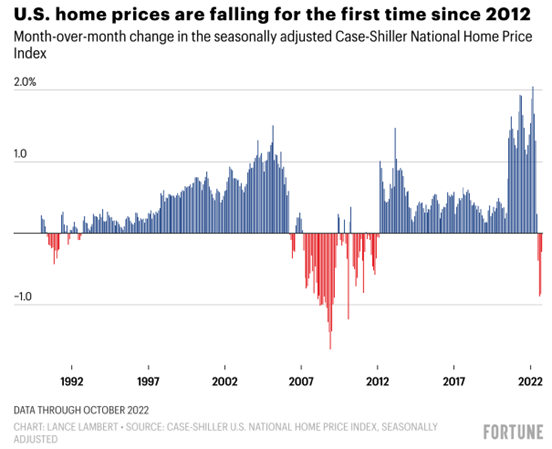

Every month, I attempt to locate a recent commentary about the national economic outlook, especially as it relates to our industry. Lance Lambert published an article in Fortune Magazine on December 27th entitled “We’re in the second biggest home price correction of the post-WWII era—here’s the latest data.” The article opened with Powell sharing “Speaking to reporters in September, Fed Chair Jerome Powell made it clear that going forward, the U.S. Housing market would get “reset” by a difficult correction. Houses were going up at an unsustainable fast level. So, the deceleration in housing prices that we’re seeing should help to bring prices more closely in line with rents and other housing market fundamentals, which is a good thing. For the longer term, we need supply and demand to better align in order for housing prices to go up at a reasonable level and pace, which would result in affordable homes again. In the housing marketing, we must go through a correction to get back to that place. This difficult [housing] correction should put the housing market back into better balance”.

Over the last four months ending in October, U.S. home prices as measured by the Cash-Shiller National Home Price Index have declined, which is the first time since 2012. In total, home prices have fallen 2.4% since their peak in June. Keep in mind that U.S. housing prices are 38% above March 2020 levels.

Mr. Lambert referenced a Moody Analytics report published in October, which forecasts that a peak-to-trough decline will come in a range of between 15% and 20%. In an article published by Business Insider on December 28, Alcynna Lloyd chronicled brief forecasts from more than a dozen respected housing economists. One that was referenced was by Ivy Zelman, who “believes that demand will continue to shrink in the US housing market — ultimately resulting in steeper price cuts. For 2023, Zelman predicts that prices could fall as much as 20%. However, in markets without supply constraints — like the midwestern and northeastern states — she says that declines could be in the mid-singles.” As one of the northeastern states, that experienced house price inflation lower than the national averages, we should not expect to drop as low as our western US peers. Click HERE to read the full article.

We referenced an economic forecast published by Fannie May last month where they believe SF housing starts will decline 22% in 2023. In the research I’ve done in December, I’d consider this a mid-point decline for economists. There is considerable variation by geography and segment. Higher mortgage rates are likely to cause fewer house resales in 2023 as well, despite demand. Rent growth is expected to slow due considering the unsettled economy. MF new starts are expected to fall from historical highs, but there is a lot of MF build activity in production.

Mortgage rates are forecasted to fall into the high 5% range from current levels. For much of December, the 30-year rate hovered in the low 6% range but pushed up to 6.5% by the end of month. Every .25% change in the 30-year mortgage rate is equivalent to an approximate change of 3% in home value! A drop of 1% would be a welcome change for affordability.

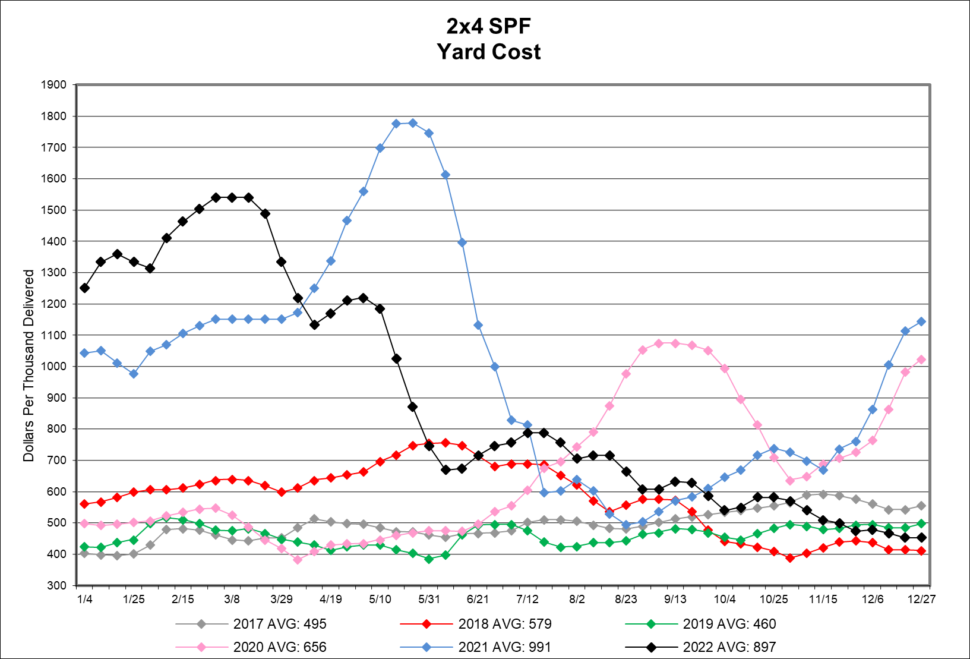

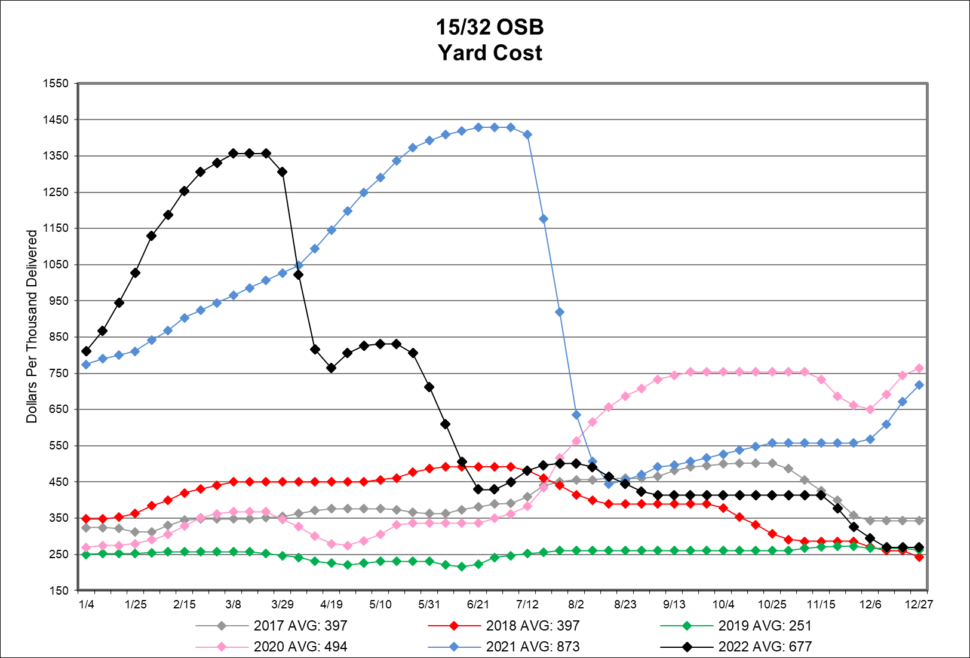

The cost of a new home has dropped meaningfully due to the approximate 65% decline in lumber and panel prices from peak levels earlier this year. Prices declined modestly in December due to the decline in demand, especially for entry level homes, across the country. Manufactures are reported to be scheduling downtime and/or other measures to stabilize pricing at such low levels.

Prices for windows will increase in January (see below for details). Increases have also been announced for James Hardie, LP SmartSide, and Styrofoam insulation. These increases don’t seem rational considering what is shared above. Prices for fasteners and other steel products are expected to decline smartly by the end of the 1st quarter.

While some lead times have drastically improved over the past year, there are product lines that still have extended lead times. A few cabinet suppliers still have lead times of 3-4 months, window & door manufacturers are 3-4 months out for certain products, and other suppliers are operating on allocation. Several are still struggling to obtain raw materials needed to produce their products. We anticipate that lead times will gradually improve in 2023.

As always, please feel free to reach out to me directly if you would like to discuss in further details. I welcome the opportunity!

Regards, Bob Wood, President

P: 717-792-2500 | E: [email protected]

—

CABINETS:

- Gallery lead times are currently 4-7 weeks.

- Omega / Dynasty lead times are currently 9-12 weeks for framed & inset cabinetry.

- Legacy lead times are 8-9 weeks.

- Timberlake lead times are 4-6 weeks.

- Quality Cabinets lead times are 2-4 weeks. Quality Woodstar lead times are 12-13 weeks.

- Aristokraft lead times are 3-5 weeks.

- WOLF Cabinetry lead time is 1-6 weeks.

WINDOWS & DOORS:

- Andersen Windows & Doors has announced a 4.5% price increase effective on all orders placed after January 12, 2023. Lead times on 100 Series are 3-5 weeks, 200 Series are 3-5 weeks, 400 Series are 3-15 weeks, A-Series are 10-12 weeks, E-Series are 9-11 weeks, MultiGlide are 10-12 weeks, and folding doors are 21-23 weeks. Assembled patio doors have extended lead times as well.

- Marvin Windows & Doors has announced a price increase effective January 16th. Signature & Skycove series will increase 4.5%, Awaken Skylights will increase 6% and the Elevate collection will increase 3.5%. Essentials will not have an increase. Lead times on the Elevate Collection is 11-12 weeks, Essential Collection is 7-8 weeks, and Signature Collection is 18-25 weeks.

- Ply Gem lead times are 7 weeks for 1500 Series Single Hung and 6 weeks for Pro Classic Double Hung. As of January 30th, Ply Gem will begin taking orders again for extruded black exterior for all 1500 Series vinyl collection window and doors.

- Simonton’s lead time is 3-5 weeks on the new construction series and 4 weeks on the replacement series.

- Silver Line lead time is 2-4 weeks on single hung and 2-4 weeks on double hung. Black & bronze color coated are an additional 3-4 weeks out.

- Atrium lead time is 3 weeks on new construction double hung, 4 weeks on new construction single hung 150/160 Series, 7 weeks for black laminate and 7 weeks on SH 130 Series.

- 7-D Windows lead time continue to be 2 weeks. Tempered glass units are 3 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

GARAGE DOORS:

- Lead times are 4-6 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue this year.

- DuPont Styrofoam has announced a 10% price increase effective January 30th.

HUBER:

- Effective January 2nd, Huber Engineered Woods will adjust pricing on AdvanTech and ZIP System accessory portfolios ranging from 1-5%.

SIDING:

- Myers is currently taking orders for January 19th on CertainTeed siding deliveries. They have also announced several new colors and products to enhance their offering for 2023. Please contact your sales rep for additional details.

- James Hardie is making adjustments to product availability and lead times to better serve the market. Effective January 3rd prices will increase 5-7% on most Hardie products and 7-10% on specialty products.

- LP SmartSide siding and trim products will have a 3-5% price increase effective January 2nd.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain.

HARDWARE:

- Allegion hardware (Schlage, Falcon, Dexter) will have a 5-10% price increase in February.

CREATE A UNIQUE LOOK WITH PLY GEM’S WEST PRO SERIES 700 SKYWALL WINDOWS.

- Created by combining casement, awning and fixed styles.

- Provides a unique skyward perspective.

- Creates a dramatic & expansive wall of light.

- Stunning design feature that opens up a room & visually brings the outside in.

FINISH WITH CONFIDENCE!

One of the latest moulding and millwork trends is accentuating windows by adding thick white trim. By adding thick trim around the outside of the window, the space maintains a clear and central focus without feeling too busy.

This is an easy look to create with Metrie’s lintel moulding and trim selection.

CLASSIC LOOKS AT

BUDGET-FRIENDLY PRICES.

Did you know moulded composite doors are one of the most popular choices for interior doors? They offer the look of classic wood at budget-friendly prices and also provide extreme durability and endless design options.