December Supply Chain Update

SUPPLY CHAIN, PRICING, PRODUCT UPDATES:

As we draft this month’s update, the world is unsettled about the new variant to the COVID virus called Omicron. Many nations have implemented revised travel restrictions, and the unknown impact of the variant has put fear in the financial markets. Optimistically, the scientific community and our health care industry will quickly address the new variant as they have with the original outbreak and the Delta variant. Economists we follow don’t assume the variant will have a negative impact for our industry, but the impact of COVID continues to touch our businesses weekly.

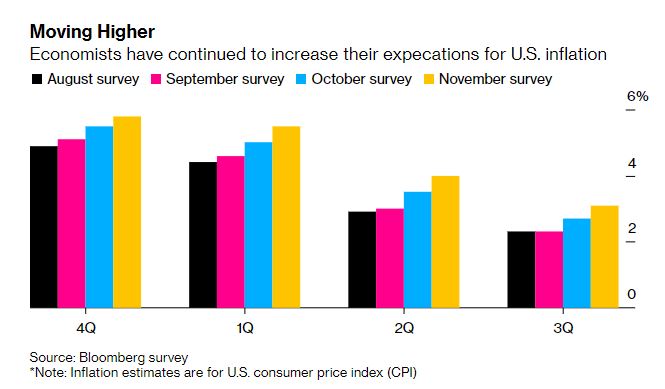

The economic indicator that is getting the most attention is inflation. From a recent Bloomberg article, it stated that “in October, consumer prices rose 6.2% from a year earlier, exceeding all projections and reflecting higher prices for energy, shelter, food and vehicles. Many economists expect inflation to get worse before it gets better due to supply chain snarls and an ongoing labor shortage”.

A key indicator for our industry related to inflation is mortgage rates, which are up .3% from summer lows to a benchmark level of 3.1% last week. Many economists forecast that mortgage rates will increase next year in relationship to debt indices, which are expected to increase due to inflation. Economists don’t believe that forecasted mortgage rates will stymie housing demand, which is forecasted to increase over the next 24 months at decreasing levels.

As we shared consistently in our updates, the demand/supply imbalance continues for many products in our industry. As you’ll see from our detailed update on pricing and lead times below, this presently is most prevalent with windows & doors, garage door, cabinets, and trusses. We’re told you are experiencing similar issues with HVAC equipment and appliances.

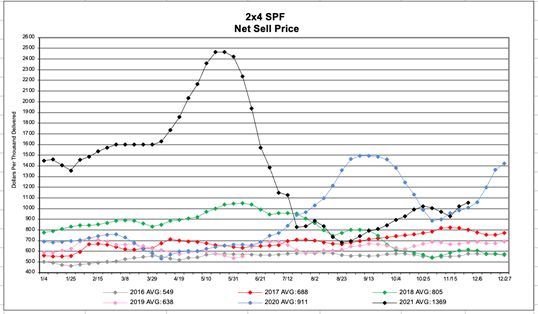

In our November update, we explained that lumber prices were trending upward since August lows, resulting from steady demand and increasing costs for transportation. Through mid-November, pricing retreated about 10%. Then the rains came! British Columbia had record rainfall in November, “Hope, B.C., about 95 miles east of Vancouver, received 11.58 inches of rain in 24 hours. Armel Castellan, a meteorologist with Environment Canada, told reporters that the rainfall over 24 to 36 hours exceeded what many locations typically see during all of November, which is the wettest month of the year.” Railroads are having a difficult time with outbound and inbound cars. This impact, coupled with steady demand, have caused prices to increase by 13% since mid-month. Futures trends are higher still.

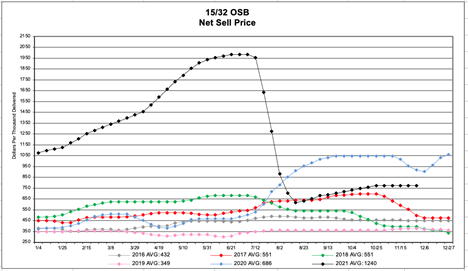

OSB is largely supplied by manufacturers in the southeast. While pricing has increased about 21% from the August low, prices were flat in November. We do sense some upward pressure in panel prices, but not to the level or with the volatility we are experiencing in lumber.

By the time we update you again, it will follow the Christmas holiday. Last year, we adjusted our businesses and work life in response to COVID-19. This year may have been more challenging as the supply chain has defined a new pace of work (and work/life balance). Thanks for hanging in there with us as we together define the new normal!

Best wishes for a restful Christmas holiday.

See below for our detailed review of lead times and price changes by product.

Regards, Bob Wood

P: 717-792-2500 | E: [email protected]

CABINETS:

- Gallery lead times have extended to 13-16 weeks.

- Omega / Dynasty lead times have extended to 18-20 weeks and announced a price increase of 12% effective December 6th.

- Legacy lead times have extended to 6-7 weeks.

- Timberlake lead times have extended to 12-14 weeks.

- Quality Cabinets lead times have extended to 9-10 weeks.

- Aristokraft lead times have extended to 16-20 weeks and announced a price increase of 17% effective January 7th.

- WOLF Cabinetry lead times have extended to 6-8 weeks. They announced a 7% price increase on their WOLF Classic line effective December 1st, as well as a 13% price increase on their Signature Series effective January 7th.

DECKING & ACCESSORIES:

- Parksite announced a 4%-10% price increase on AZEK / TimberTech Deck & Porch products effective December 6th. AZEK / TimberTech railing will increase anywhere from 2%-9% effective December 6th.

- Trex has announced a price increase to go into effect in January. The amount of increase has yet to be shared. Additional details will be provided.

MILLWORK:

- Fypon has announced a 7% price increase effective February 7th.

- BWI / Masonite has announced the following price increases effective January 12th, as well as product discontinuations. Click HERE for additional details.

- Flush Interior Doors: 21%

- Molded Hollow Core Interior Doors: 13%

- Molded Solid Core Interior Doors: 8%

- Stile & Rail Doors: 11%

- Steel Exterior Doors & Frames: 12%

- Fiberglass Exterior Doors: 11%

- Decorative Glass Units: 14%

- Standard Glass Units: 10%

WINDOWS & DOORS:

- Andersen Window lead times on 100 Series is 13 weeks, 200 Series is 7 weeks, 400 Series is 9-16 weeks, and A-Series is 14 weeks. Patio door lead times on 100 Series is 18 weeks, 200 Series is 8-14 weeks, and folding doors are 21 weeks.

- Marvin Doors and Windows lead times on Elevate Collection is 13-14 weeks, Essential Collection is 9-10 weeks, Signature Collection is 15-22 weeks.

- Ply Gem continues to have extended lead times. 1500 Series Single Hung is 28 weeks, and the Pro Classic Double Hung is 16 weeks.

- Simonton’s lead time is 16 weeks on the new construction series and 8-10 weeks on the replacement series.

- Silver Line lead time is 14 weeks on single hung and 9 weeks on double hung.

- Atrium lead time is 12 weeks on new construction double hung, 30 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series.

- 7-D Windows lead times continue to be 3-4 weeks. Tempered glass units are 12 weeks. Contact your sales rep if should these lead times enable a quick turn project.

- Therma-Tru has announced a price increase effective February 4th.

- Fiberglass Doors 16%-18%

- Steel Doors 18%-20%

- Composite Frames 20%-22%

GARAGE DOORS:

Lead times are 16-20 weeks depending on style and color selection.

INSULATION:

Insulation continues to be on allocation and supply issues will more than likely continue into the winter.

- Knauf Insulation has announced a 10% price increase effective December 3rd.

ROOFING:

- EPDM rubber roofing & accessories all have extended lead times, anywhere from 60-120 days depending on the product.

- We are experiencing significant extended lead times, ranging from 45 to 75 days, on coil stock, roof edge, and flashing products.

- GAF’s supply and color availability continue to be very limited. GAF has extended their current promotion. You can earn up to 2.5% back in rewards points. Click HERE to view. Please see your Myers rep for additional details.

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and we are expanding our TAMKO Titan XT line from 6 to 10 colors. TAMKO has also extended their promotion. Receive cash back on your qualify TAMKO Titan Proline XT purchases. Click HERE to view.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

- Henry Eaveguard has announced a potential price increase effective January 1st. Additional details will be provided.

SIDING:

- LP SmartSide Trim & Siding has announced a 8%-12% price increase effective December 13th.

- Berger has announced an 8%-12% increase effective December 6th. We continue to experience extended lead times on all coil stock, flashing & roof edge.

- Boral has announced a 10%-11% increase effective December 1st.

- Mid-America has announced a12%-14% increase effective December 1st. Lead times have been extended as well.

- Barricade has announced a 10% price increase effective December 1st.

- CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers sales rep for clarification on the availability of your color selection. All CertainTeed products are on allocation, and we are still experiencing extended lead times. We are currently out to December 21st with orders. Please click HERE to review a list of discontinued CertainTeed products.

- James Hardie has announced a potential price increase effective January 1st. Additional details will be provided. They have also announced that all Hardie Shingle Siding are now on allocation and discontinuation of products. Click HERE for additional details.

EWP:

LP is on allocation and is experiencing extended lead times of 3 to 4 weeks. Keep in contact with your sales rep for up-to-date information.

HARDWARE:

Since March 2020, steel prices have more than doubled due to raw material shortage and escalated shipping costs. We anticipate this continuing into 2022.