October Supply Chain Update

The financial markets turned down sharply in September in connection with initiatives to tame inflation. On September 21 the Fed increased the Fed Funds rate by .75% as predicted. In NAHB’s Eye on Housing Update dated September 21, Robert Dietz shared “Looking forward, the Fed’s “dot plot” indicates that the central bank expects the target for the federal funds rate will increase by 75 more basis points in November, 50 in December, and then concluding with 25 points at the start of 2023. This would take the federal funds top rate to near 4.8%. Combined with quantitative tightening from balance sheet reduction (in particular, $35 billion of mortgage-backed securities (MBS) per month), this represents a significant amount of monetary policy tightening over a short period. Given this policy path, a hard landing with a mild economic recession is all but unavoidable to bring inflation back to the Fed’s target. By 2025, the Fed is forecasting a return to a normalized rate of 2.5% for the federal funds rate.” Click HERE to read the full article.

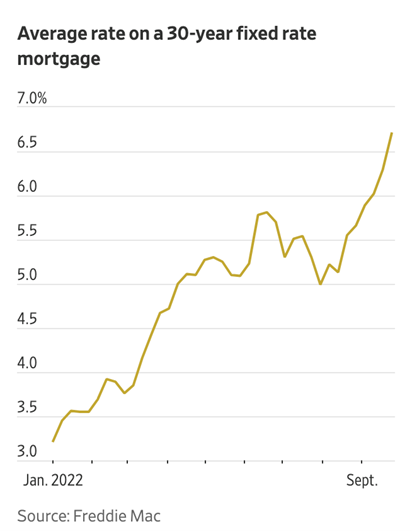

As we’ve discussed in prior updates, the major implication on our industry is the impact on mortgage rates. In late September, mortgage rates increased by .4% to 6.7%. A year ago, rates were 3%. Charlie Grant, in an article published in The Wall Street Journal on September 29 stated “Mortgage rates usually rise or fall in tandem with the benchmark 10-year Treasury yield, not the rate set by the Fed, but the 10-year yield is heavily influenced by expectations for Fed rates. The 10-year yield has ricocheted this week during broad turmoil in the bond markets. On Wednesday, the 10-year yield briefly touched 4%, its highest in more than a decade. It fell sharply later that day, notching its biggest one-day decline since 2009.” In July, mortgage rates declined after the initial large increase linked with Fed policy due to the large decline in new loans. It will be interesting to see if rates moderate in October, presuming the 10-year treasury rate becomes less volatile.

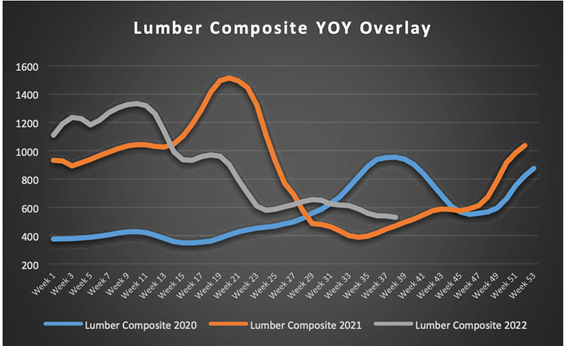

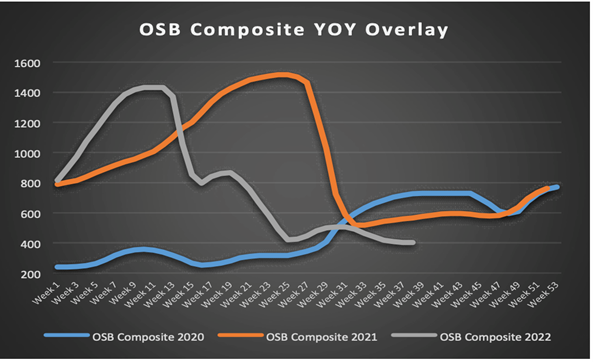

On September 28, Ryan Dezember published an article in The Wall Street Journal entitled “Lumber Prices Fall Back to Around Their Pre-Covid Levels”. In fact, lumber costs have fallen 70% from their peak in March. His research suggests that this cheaper wood has given builders some wiggle room as they wrestle with inflationary prices for other products and the impact of higher mortgage rates. He quoted Paul Jannke of Forest Economic Advisors LLC, who suggests that lumber consumption will decline in 2024 and 2025 in connection with a normalization of construction and remodeling demand from the pandemic related boom.

Mr. Dezember then shared that “Despite the steep drop in consumption, Mr. Jannke and others expect wood prices to be much higher than during previous downturns—in the $400s per thousand board feet, rather than the $200s—due to record-low inventories among dealers and rising mill costs, especially in British Columbia, forest fires, wood-boring beetles and conservation efforts have reduced the supply of logs.” In fact, some mills have recently established price thresholds and have implemented curtailments to stymie the continuing decline in prices. Click HERE to read the full article (a WSJ subscription is required).

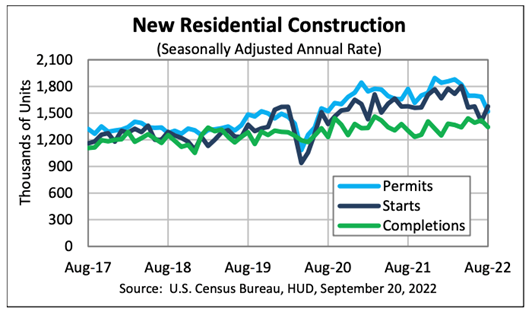

According to the Census Bureau, the rate at which new U.S. housing is being built is down about 13% from April, when residential construction activity hit its highest level in more than a decade.

New permit and start trends are down between 12% and 14% from last August. Completions are up 3% in August from prior year levels as the industry catches up from supply chain influenced backlogs. As we suggested in prior month reports, SF activity has slowed, but not stopped. MF activity continues to be strong as entry level buyers struggle to qualify for mortgages for new or existing homes. The existing home market has understandably been impacted too. Prices have softened, the number of days properties are on the market is increasing and the number of properties for sale has trended up. These trends are not back to pre-pandemic levels, but are different from earlier this year.

In Zonda’s New Home Market Update: August 2022 dated September 22, it was reported that “The New Home Pending Sales Index, a leading residential real estate indicator based on the number of new home sales contracts signed across the country, came in at 107.9, representing a 25.0% decline from the same month last year.” As a result, Ali Wolf, their Chief Economist, reported in Zonda’s September Market Webinar that builders nationally are reducing prices, offering incentives and retooling their business models considering the large change in mix from the pandemic surge in entry level homes. As we explained last month, she reinforced that housing activity is different regionally. We sense the Pennsylvania market is somewhat stronger than the Maryland market in recent months based on business demand and new estimating activity. Click HERE to listen to Zonda’s webinar.

Supply chain lead times versus pre-pandemic state continue to be extended, particularly for windows, doors, garage doors, and kitchen and bath cabinets. Please see detailed information below by product line and vendor. Rumors persist that we will see prices retract for some product lines in future months, but nothing like what has transpired for lumber and panels.

In closing, I want to acknowledge our US LBM colleagues and residents of Florida as they begin a new journey of recovering from the devastation caused by Ian. The cleanup will require a lot of help from our industry. Thus far it’s not impacted our supply chain, but it may be too early to assimilate the cleanup timing and effort.

Regards,

Bob Wood, President

E: [email protected] P: 717-792-2500

CABINETS:

- Gallery lead times are currently 5-9 weeks.

- Omega / Dynasty lead times are currently 5-8 weeks for framed & inset cabinetry. Omega has also announced several product discontinuations. Click HERE for list.

- Legacy lead times are 8-9 weeks.

- Timberlake lead times are 8-12 weeks.

- Quality Cabinets lead times are 2-4 weeks. Quality Woodstar lead times are 8-9 weeks.

- Aristokraft lead times are 3-5 weeks.

- WOLF Cabinetry lead times are 4-6 weeks.

- CounterTek has announced a price increase of 9% effective October 10th.

WINDOWS & DOORS:

- Andersen Windows & Doors lead times on 100 Series are 5-10 weeks, 200 Series are 2-4 weeks, 400 Series are 3-15 weeks, A-Series are 13-15 weeks, E-Series are 9-11 weeks, MultiGlide are 9-11 weeks, and folding doors are 22-24 weeks.

- Marvin Windows & Doors lead times on the Elevate Collection is 14-15 weeks, Essential Collection is 13-14 weeks, and Signature Collection is 17-25 weeks.

- Ply Gem lead times are 8 weeks for 1500 Series Single Hung and 8 weeks for Pro Classic Double Hung.

- Simonton’s lead time is 2-4 weeks on the new construction series and 2-3 weeks on the replacement series.

- Silver Line lead time is 2 weeks on single hung and 2 weeks on double hung. Black & bronze color coated are an additional 3-4 weeks out.

- Atrium lead time is 7 weeks on new construction double hung, 8 weeks on new construction single hung 150/160 Series, and 15 weeks on SH 130 Series.

- 7-D Windows lead time continue to be 2 weeks. Tempered glass units are 3 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

GARAGE DOORS:

- Lead times are 6-8 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue through this year.

- Knauf has announced a 10% price increase effective December 2nd.

ROOFING:

- EPDM rubber roofing & accessories have extended lead times & are on allocation.

SIDING:

- Myers is currently taking orders for October 20th on CertainTeed siding deliveries. CertainTeed has also announced several product discontinuations. Please click HERE for additional details.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain.

Finishing touch that brings elegance to any room.

With all the different types of mouldings to choose from with Metrie, creating something special that represents the personality of your client is easy! If there’s one type that stands out from the rest, it’s decorative panel moulding! It’s an interesting and unique solution to the trendy paneled aesthetic because it transforms the ceiling, wall, or otherwise flat surface into something new and exciting. Panel moulding is the picture-perfect option for making a room look and feel finished.

Metrie’s curated collections and hundreds of profiles and options make it easy to kick it up a notch! Want to learn more about what’s available to you? Contact your sales rep to begin the conversation.

Make a stunning statement with Ply Gem Windows.

With styles and options to meet the demands of even the most discriminating homeowner and performance to match, Ply Gem Windows bring a lifetime of luxury. They have products and solutions for new construction or remodeling projects that range from custom, architectural solutions to operable geometric styles. Available in vinyl, aluminum clad, wood composite and aluminum, Ply Gem Windows are functional, high performing and energy-efficient. With bold colors and unique design options, they’re sure to be a hit with any of your customers.

Interested? Get in touch with your local Myers location or your sales rep.

Get SMART with Schlage!

Your customers want them and we got ’em! These days it’s all about convenience and smart home technology continues to be in high demand. One often overlooked area for an upgrade opportunity is door hardware. Schlage has a wide selection of smart locks that fit with any smart home and can connect with options like WiFi, bluetooth, Alexa, Google Assistant and now even Apple watches! With an easy-to-install Schlage keypad, coming and going is keyless, effortless—and painless. Make your customers lives easier with Schlage Smart Locks.

Want to see them for yourself? Stop in. We’d be glad to show you all the bells and whistles.