October Monthly Update

SUPPLY CHAIN, PRICING, PRODUCT UPDATES:

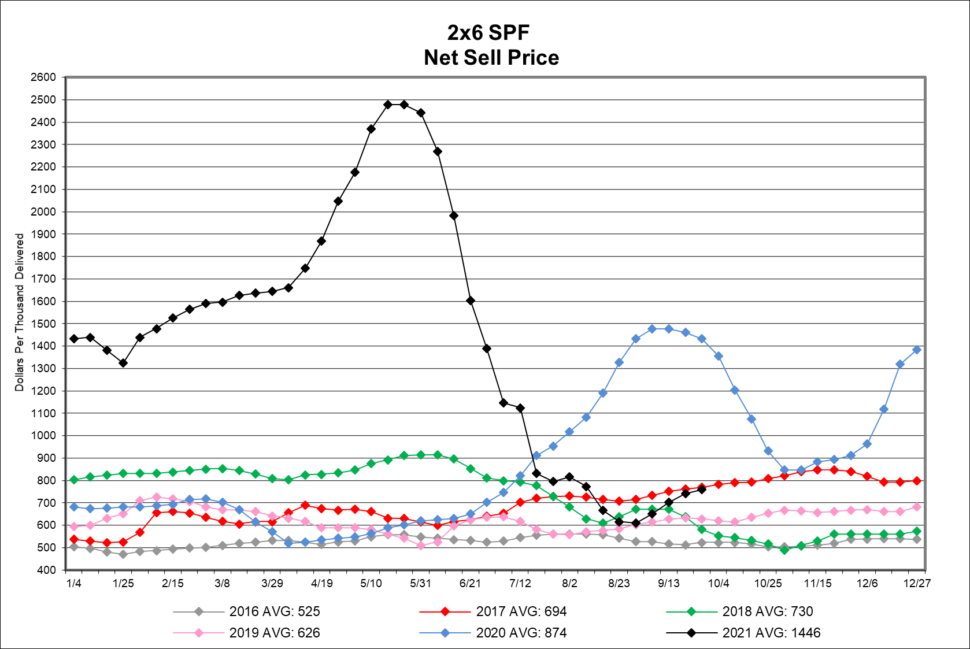

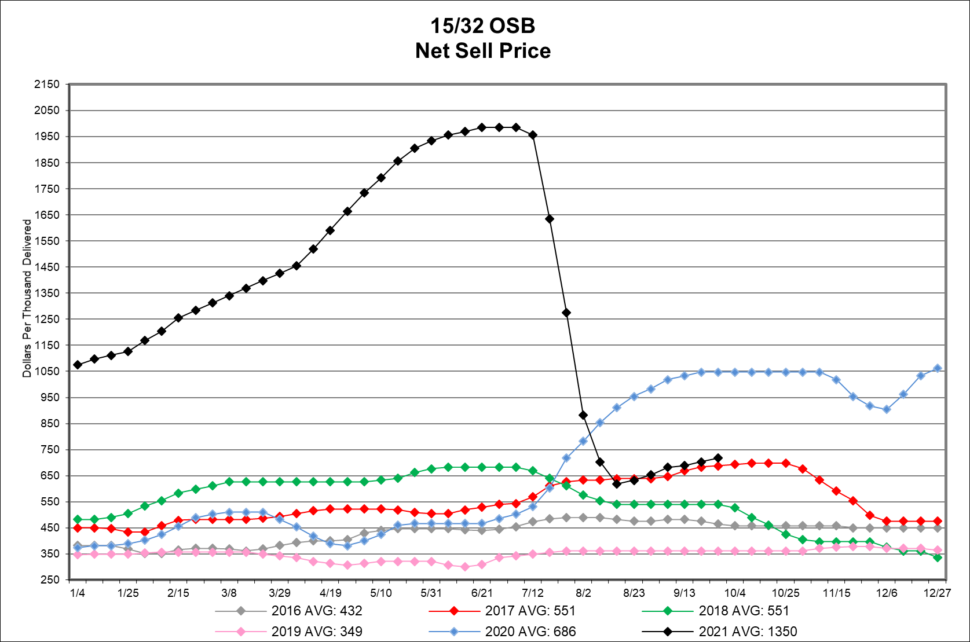

Lumber and panel prices found a bottom in late August and have gradually increased weekly since then. As you’ll see from the graphs below, prices have increased about 17% from the bottom but are about 70% less than the peak levels experienced in the 2nd quarter of 2021. Looking at Futures pricing, out 60 to 120 days, these commodities are posting 24% higher than the prices reflected in the charts. If prices increase to these future levels, they will still be under the spikes we experienced through the 1st half of 2021.

Historically low mortgage rates and supply of existing homes continue to fuel demand despite a large increase in home costs. The Producer Price Increase for Inputs to Residential Construction are up 20.4% (US Bureau of Labor Statistics) since February 2020. As a byproduct, the Cash-Shiller National Home Price Index increased 24% from February 2020, 13% in 2021 alone. We sense the demand/supply balance has normalized around the capacity of the supply chain to support new construction and remodeling. Many of you desire to do more but are limited by material and/or labor availability. In fact, several of our suppliers are reporting that the components they require to make their products are becoming even more difficult to secure. This is reflected in the spirit of our monthly update as we feel compelled to make you aware of changing lead times and costs.

Unfortunately, there are few products that have not been affected by the strained supply line. At the present time we have limited availability and extended lead times on OSI caulk, subfloor adhesive, drainage products, pocket door frames and coil nails.

A few material changes in September follow:

- Andersen Windows & Doors 7% price increase went into effect on September 13th.

- EWP supply chain remains stressed and on allocation.

- Availability of siding colors are limited and by year end several products will be discontinued in the CertainTeed line.

See below for an outline of price changes and lead times for the products you secure for your projects.

Please don’t hesitate to contact me if you have questions or if I can be of assistance to you. Thank you for your continued support as we navigate through this challenging market!

Regards, Bob Wood

P: 717-792-2500 | E: [email protected]

CABINETS:

Lead Times & Price Increases:

- Gallery lead times have extended to 17-18 weeks.

- Omega / Dynasty lead times have extended to 18-20 weeks.

- Legacy lead times have extended to 6-7 weeks.

- Timberlake lead times have extended to 12-14 weeks and announced a 6% price increase effective October 1st.

- Quality Cabinets lead times have extended to 9-10 weeks.

- Aristokraft lead times have extended to 12-13 weeks and announced a 1% price increase effective October 1st.

- WOLF Cabinetry lead times have extended to 6-8 weeks. They have also announced a 7% price increase on their WOLF Classic line effective December 1st.

DECKING & ACCESSORIES:

Price Increases:

- Trex will be increasing prices on November 1st. Resin price escalation, labor issues, and freight cost are the leading factors causing this increase.

MILLWORK:

Price Increases:

- Versatex has announced a 7% price increase, effective October 31st, due to Resin pricing and many other increases relative to raw material and production costs.

- Reeb has announced the following price increases effective November 1st:

- Flush & Molded Doors: 10-12%

- Primed, Clear & Knotty Pine Doors: 25%

- White Pine Doors: 12%

- Woodgrain Doors: 12%

- BWI has announced an 8% price increase on all stile and rail doors, effective October 20th.

WINDOWS & DOORS:

Lead Time & Price Increases:

- Andersen Window lead times on 100 Series is 16 weeks, 200 Series is 7 weeks, 400 Series is 8-10 weeks, and A-Series is 9 weeks. Patio door lead times on 100 Series is 18 weeks, 200 Series is 10 weeks, and folding doors are 20 weeks. A price increase of 7% will go into effect October 25th on all storm door products.

- Marvin Doors and Windows lead times on Elevate Collection is 11-13 weeks, Essential Collection is 9-10 weeks, Signature Collection is 23 weeks.

- Ply Gem continues to have extended lead times. 1500 Series Single Hung is 40 weeks, and the Pro Classic Double Hung is 19 weeks.

- Simonton’s lead time is 16 weeks on the new construction series and 13 weeks on the replacement series.

- Silver Line lead time is 19 weeks on single hung and 11 weeks on double hung.

- Atrium lead time is 6 weeks on new construction double hung, 14 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series.

- 7-D Windows lead times continue to be 3 weeks. Tempered glass units are 4-6 weeks. Contact your sales rep if should these lead times enable a quick turn project.

GARAGE DOORS:

Lead times are 16 weeks depending on style and color selection.

GYPSUM:

There will be a 10% price increase on all Gypsum products effective October 1st.

LUMBER & PANELS:

If the price swings in lumber and panels have you in a quandary, trust us you are not alone. When the lumber market peaked at record high numbers in late May and then dropped close to pre-COVID numbers by late August, everyone was left with several unanswered questions. How did it get so high and what caused the sudden and speedy retreat in prices? There are multiple answers, supply and demand were out of balance, COVID, shipping, global economy, but that is how the free enterprise system works.

INSULATION:

Insulation continues to be on allocation and supply issues will more than likely continue into the fall.

ROOFING:

Lead Times & Price Increases:

- EPDM rubber roofing & accessories all have extended lead times, anywhere from 30 – 90 days depending on the product.

- We are experiencing significant extended lead times, ranging from 45 to 75 days, on coil stock, roof edge, and flashing products.

- GAF’s supply and color availability continue to be very limited.

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and we are expanding our TAMKO Titan XT line from 6 to 10 colors as available.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

- Mid-America is experiences extended lead times ranging from 30-60 days.

SIDING:

CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers sales rep for clarification on the availability of your color selection. All CertainTeed products are on allocation, and we are still experiencing extended lead times. We are currently out to October 14th with orders. They have announced a price increase of 10% effective October 18th. Please click HERE to review a list of discontinued CertainTeed products.

EWP:

LP is on allocation and is experiencing extended lead times of 3 to 4 weeks. Keep in contact with your sales rep for up-to-date information.

HARDWARE:

- Simpson Strong-Tie has announced a price increase of 12% effective October 13th.

- Schlage has announced a 3% price increase effective October 4th.