November Supply Chain Update

SUPPLY CHAIN, PRICING, PRODUCT UPDATES:

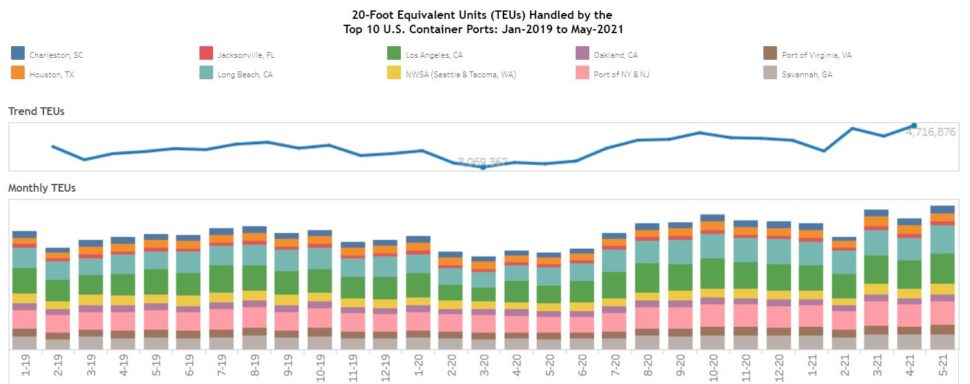

This month, we’ve elected to reference international shipping metrics to illustrate the themes that are impacting our economy and businesses. The volume of containers being handled by the ports in the United States is historical, much higher than in 2019 (pre-pandemic).

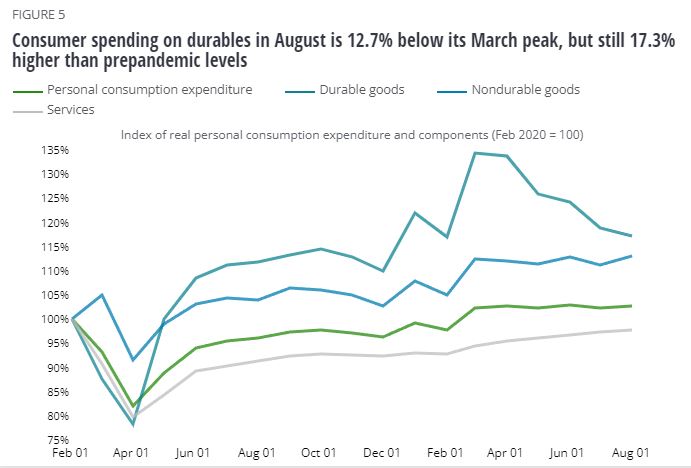

The graph shared below, shows how we, as consumers, are driving demand. Personal consumption expenditures and durable goods spending, while down somewhat from summer peaks, are still noticeably higher than pre-pandemic levels. Economists suggest this is attributable to our spending from stimulus funds and increased savings during the early part of the pandemic. It is also prompted by higher employment rates.

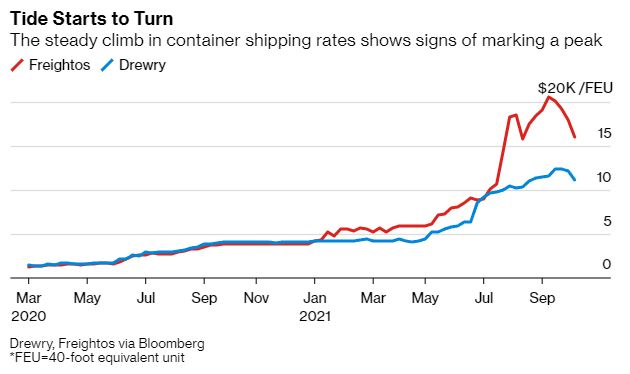

In reference to the graph below, the cost to ship products internationally has multiplied as a result. What once cost $2,000 per container has increased to as much as $20,000. Note that these trends peaked recently and are showing signs of a decline. Will this part of the supply chain normalize around the capacity available, as we’ve experienced with lumber and panels?

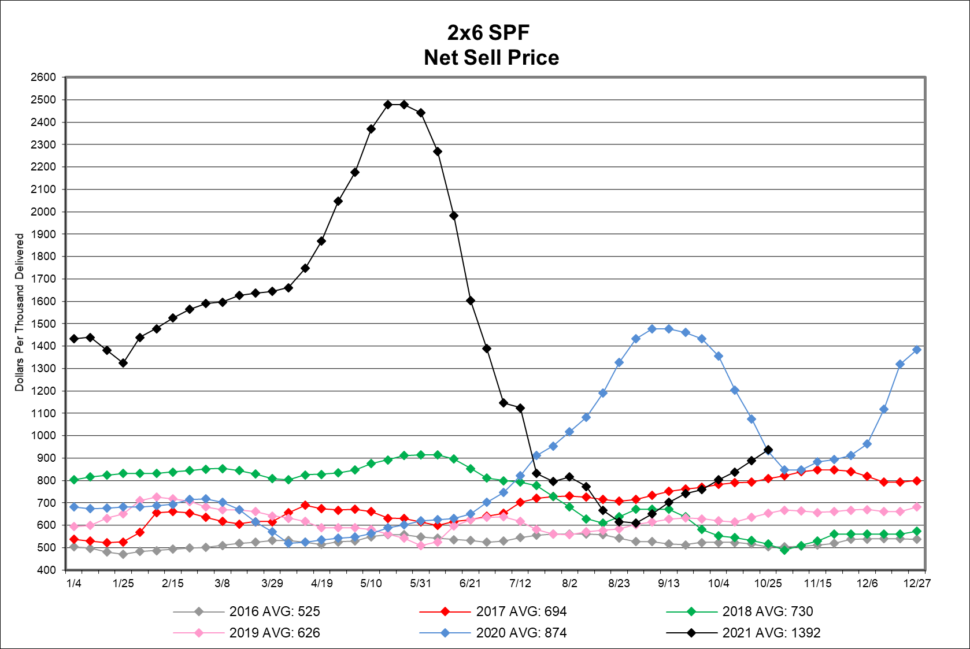

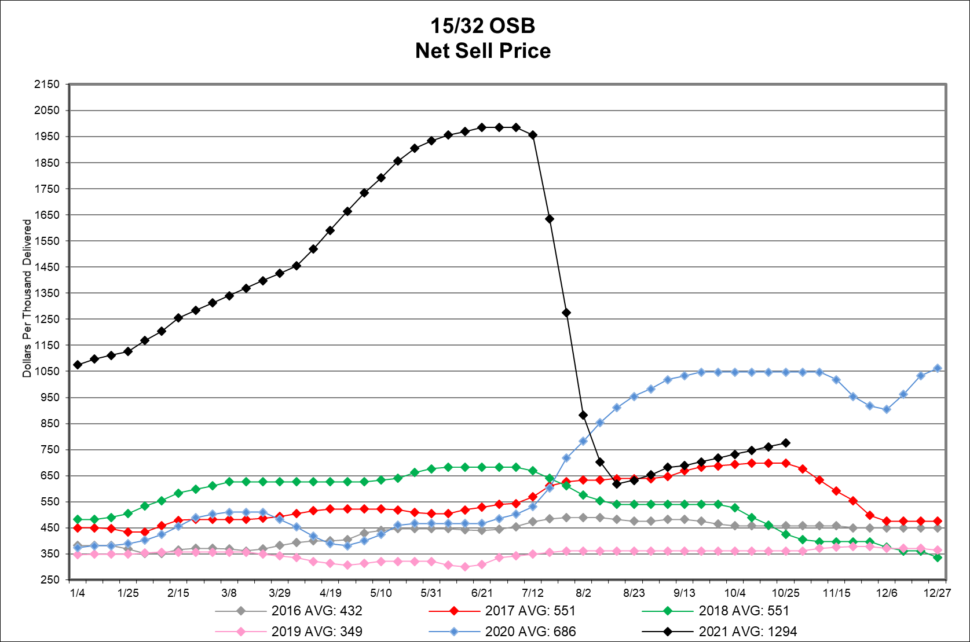

Lumber and panel prices increased weekly throughout October. As you’ll see below, lumber’s rate of increase has been sharper. The increases in price are prompted by the strong construction market. As we shared in our August update, SF and MF construction units are expected to grow through 2025. As we exit October, futures pricing for lumber is showing some weakness despite increased pricing for almost two months.

Pricing for other building products continue to rise. These increased prices are driven by both cost and demand. Lead times are stretched as labor and materials needed for manufacturing and are scarce.

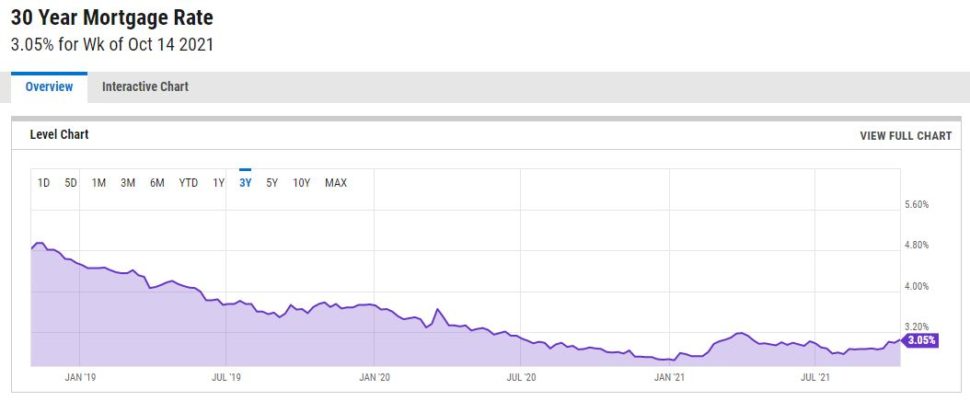

With inflationary pressures like those described above, mortgage rates are trending up in line with increases in the debt market. As you’ll see from the chart below, they remain at low historical levels, which is beneficial for our industry. The Fed is reported to be tracking inflation closely and is hopeful commodity markets like lumber will self-correct. Can we expect future corrections in other building products lines, like we experienced with lumber?

This month’s update is lengthy due to many stretched lead times and further price increases. Let us know if you need further details by vendor or product line. Thanks for your trust during these wild times!

Regards, Bob Wood

P: 717-792-2500 | E: [email protected]

CABINETS:

Lead Times & Price Increases:

- Gallery lead times have extended to 13-16 weeks.

- Omega / Dynasty lead times have extended to 18-20 weeks and announced a price increase of 12% effective December 6th.

- Legacy lead times have extended to 6-7 weeks.

- Timberlake lead times have extended to 12-14 weeks.

- Quality Cabinets lead times have extended to 9-10 weeks.

- Aristokraft lead times have extended to 16-17 weeks and announced a price increase of 17% effective January 7th.

- WOLF Cabinetry lead times have extended to 6-8 weeks. They announced a 7% price increase on their WOLF Classic line effective December 1st, as well as a 13% price increase on their Signature Series effective January 7th.

DECKING & ACCESSORIES:

Price Increases:

- RDI Railing has announced a 6 to 23% price increase effective November 8th.

- Fiberon has announced a price increase of 3 to 14% effective November 1st.

MILLWORK:

Price Increases:

- Versatex has announced a 7% price increase, effective October 31st, due to Resin pricing and many other increases relative to raw material and production costs.

- Reeb has announced the following price increases effective November 1st:

- Flush & Molded Doors: 10-12%

- Primed, Clear & Knotty Pine Doors: 25%

- White Pine Doors: 12%

- Woodgrain Doors: 12%

- BWI / Masonite has announced the following price increases effective January 3rd:

- Flush Interior Doors: 20%

- Molded Hollow Core Interior Doors: 11%

- Molded Solid Core Interior Doors: 8%

- Stile & Rail Doors: 8%

- Steel Exterior Doors & Frames: 11%

- Fiberglass Exterior Doors: 11%

- Decorative Glass Units: 14%

- Standard Glass Units: 10%

WINDOWS & DOORS:

Lead Time & Price Increases:

- Andersen Window lead times on 100 Series is 16 weeks, 200 Series is 7 weeks, 400 Series is 9-11 weeks, and A-Series is 10 weeks. Patio door lead times on 100 Series is 18 weeks, 200 Series is 10 weeks, and folding doors are 21 weeks.

- Marvin Doors and Windows lead times on Elevate Collection is 13-14 weeks, Essential Collection is 9-10 weeks, Signature Collection is 19-22 weeks.

- Ply Gem continues to have extended lead times. 1500 Series Single Hung is 38 weeks, and the Pro Classic Double Hung is 20 weeks.

- Simonton’s lead time is 16 weeks on the new construction series and 8-10 weeks on the replacement series.

- Silver Line lead time is 14 weeks on single hung and 8 weeks on double hung.

- Atrium lead time is 12 weeks on new construction double hung, 30 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series.

- 7-D Windows lead times continue to be 3-4 weeks. Tempered glass units are 6-10 weeks. Contact your sales rep if should these lead times enable a quick turn project.

GARAGE DOORS:

Lead times are 16-20 weeks depending on style and color selection.

INSULATION:

Insulation continues to be on allocation and supply issues will more than likely continue into the winter.

- Knauf Insulation has announced a 10% price increase effective December 3rd.

ROOFING:

Lead Times & Price Increases:

- EPDM rubber roofing & accessories all have extended lead times, anywhere from 60-120 days depending on the product.

- We are experiencing significant extended lead times, ranging from 45 to 75 days, on coil stock, roof edge, and flashing products.

- GAF’s supply and color availability continue to be very limited. GAF has extended their current promotion. You can earn up to 2.5% back in rewards points. Click HERE to view. Please see your Myers rep for additional details.

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and we are expanding our TAMKO Titan XT line from 6 to 10 colors. TAMKO has also extended their promotion. Receive cash back on your qualify TAMKO Titan Proline XT purchases. Click HERE to view.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

- Mid-America is experiences extended lead times ranging from 30-60 days.

- Henry Eaveguard has announced a potential price increase effective January 1st. Additional details will be provided.

SIDING:

- CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers sales rep for clarification on the availability of your color selection. All CertainTeed products are on allocation, and we are still experiencing extended lead times. We are currently out to November 11th with orders. Please click HERE to review a list of discontinued CertainTeed products.

- James Hardie has announced a potential price increase effective January 1st. Additional details will be provided.

EWP:

LP is on allocation and is experiencing extended lead times of 3 to 4 weeks. Keep in contact with your sales rep for up-to-date information.

HARDWARE:

Since March 2020, steel prices have more than doubled due to raw material shortage and escalated shipping costs. We anticipate this continuing into 2022.