March Supply Chain Update

As we write this month’s industry update, Russia just invaded the Ukraine. It’s too early to comprehend the impact this will have on the global economy and on our housing market. Not surprisingly, the financial markets have already reacted. The equity markets have declined smartly, and the debt markets have softened from the rapid rise we experienced since the beginning of the year as investors seek the safety of bonds. My interest in this conflict however is unrelated to the political agendas and related economic impact. Instead, I’m focused on the people. In the early 2000s, my daughter and I spent about a week in Kharkov on a mission trip. It’s tough to comprehend the anxiety that the Ukrainians and especially the soldiers must have with this conflict. May we remember the people as we follow this event in the weeks and months to come.

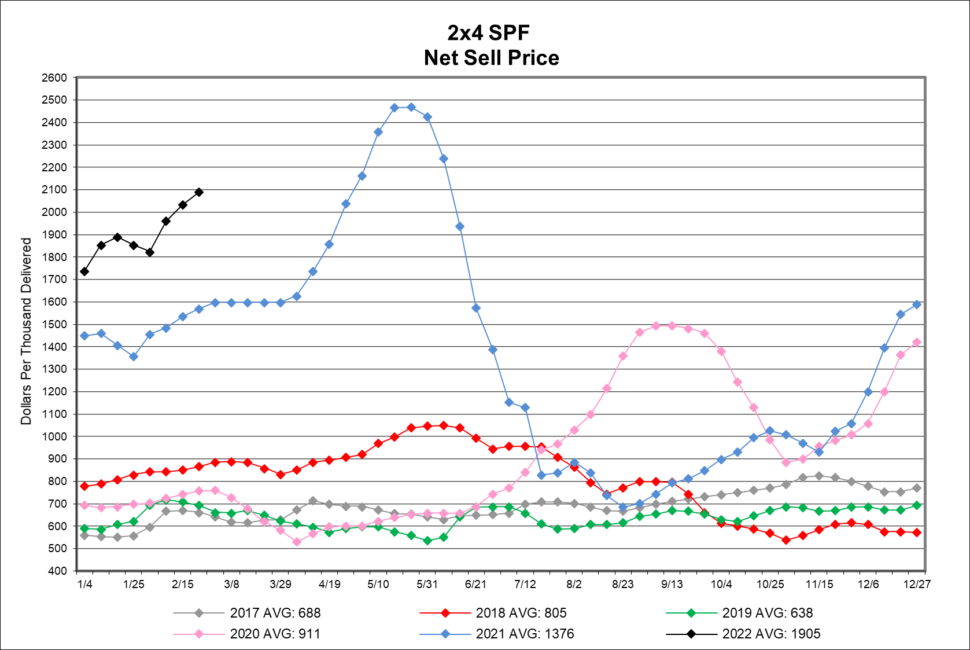

On the front page of February 23rd’s Wall Street Journal, an article entitled “Lumber Trading is So Hot That it Almost Never Happens” touches on the lives of lumber futures traders who are impacted by the recent rapid rise and extreme volatility in the lumber market. Who would have thought two years ago that lumber futures would get this much attention – routinely on the front page of the journal. Like with any futures market, daily limits are established for increases or decreases in futures pricing to protect the market from emotional and/or electronic based trading. With the rapid increase in pricing these last few months, traders are routinely at rest because limits are quickly hit.

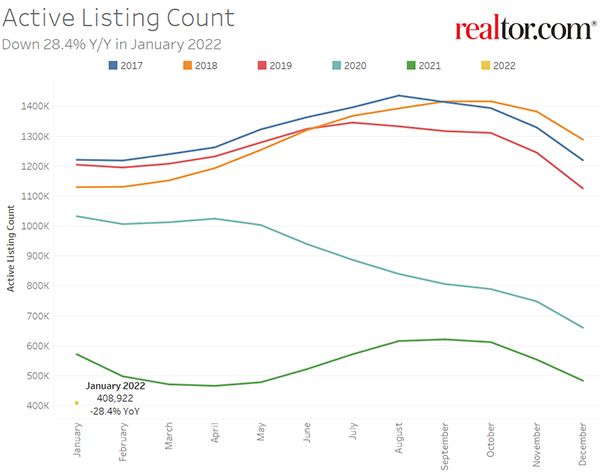

As we’ve shared in prior months, demand for SF homes continues nationally and locally despite the 20%+ annualized increase in home costs. The strong economy and related low unemployment rate favorably impact demand, even before accounting for the normal demographic demand seeking to transition into a new or different home. Existing home inventory available from folks for sale is down considerably from last year (and normal patterns – see chart to the left) which “forces” buyers to consider new homes instead. We hear from many of you about continued strength in lead activity despite the inflationary pricing impacted by both costs and in increased mortgage rates.

Last month, we shared how mortgage rates increased by .5% since the beginning of 2022. In February, the 30-year rate increased an additional .3% to 3.9% as 10-year treasuries continue to push higher due to inflation. Interestingly, the treasury rate, which mortgage rates tend to track against, softened slightly due to the invasion referenced above as investors sought the security of bonds. Click HERE for The Washington Post’s February 23rd article from the entitled “Mortgage Rates Dip Because of Global Tensions”.

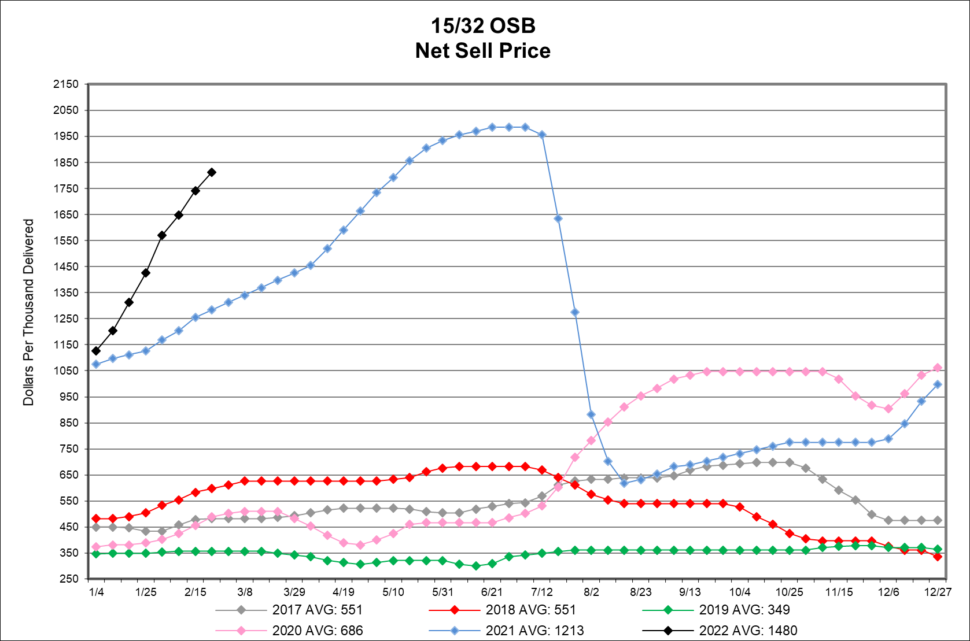

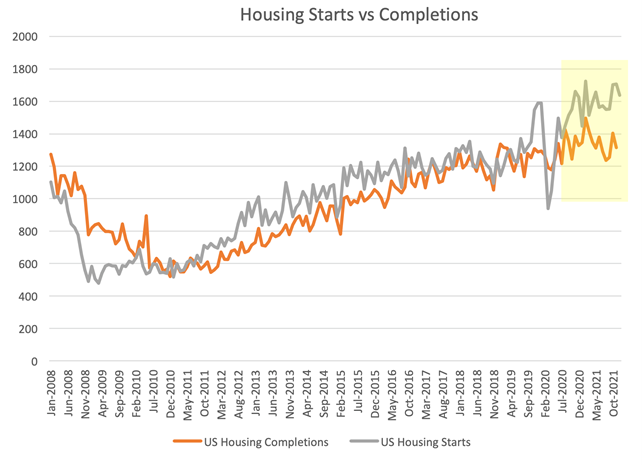

All this said, what’s up with lumber pricing? Housing permits have far outpaced new homes sales for months, due primarily to the supply chain challenges in securing the products and labor necessary to complete homes. This backlog, together with builders attempting to buy ahead to a limited extent, continues to push demand against restricted capacity impacted by Covid, winter and stressed logistics.

After a brief pullback at the end of January, lumber prices have again pushed higher, and futures pricing is also up from month end levels. Demand for OSB has continued to be under stress and availability of panels is tight. As we shared in last month’s update, if you have a large project, and especially a MF project, please give your Myers sales representative advanced notice regarding the timing of your project, so we can work with you to source your products. We don’t sense a softening, in the short term, based on the industry and economic backdrop.

Please take note of the EWP update in the product section below. EWP manufacturers have notified their dealer network that sizeable price increases will become effective at the end of this quarter, which are due to increased raw material costs and national demand.

As you come to expect, there are many price increase announcements that we’ve included below. Lead times vary by product line and manufacturer, some have improved while others have worsened. All are pushed out from pre-pandemic levels.

Thanks for the encouragement many of you have shared with us about our monthly commitment to keep you updated on the market. We will persevere together!

Regards, Bob Wood, President

P: 717-792-2500 | E: [email protected]

CABINETS:

- Gallery lead times are currently 9-14 weeks.

- Omega / Dynasty lead times are currently 8-12 weeks for framed & inset cabinetry. Full access cabinetry lead times are 18-22 weeks.

- Legacy lead times are 7-8 weeks.

- Timberlake lead times are 8-12 weeks. They have also announced a 12% price increase effective March 14th.

- Quality Cabinets lead times are 9-10 weeks.

- Aristokraft lead times are 20-22 weeks. They have also announced a 10% price increase effective March 24th.

- WOLF Cabinetry lead times are 6-8 weeks. There will be a 10% price increase on their Signature Series effective March 25th. They have also discontinued several products in the Signature Series effective March 24th. Click HERE to see list.

MILLWORK:

- Metrie has announced a price increase of 8-12% on pine & primed moulding effective March 1st.

FLOORING:

- Mohawk has announced a 5% increase on all Residential and Mainstreet commercial carpet styles and a 3-5% increase on all Resilient LVT, wood, laminate products and accessories.

WINDOWS & DOORS:

- Andersen Window lead times have become complex and will change on a day-to-day basis. Basic options can add to the lead times on all window lines making it impossible to give estimated lead times on various window lines at this time. To determine the lead time all options and selections will have to be made before Andersen can establish the lead time for the order. Andersen E-Series window lead times are out 52 weeks due to material shortages.

- Velux has reintroduced Velux Solar Skylight Shades. Last summer, Velux was forced to limit skylight shade production due to the global microchip shortage. Lead times are 7-10 days. They have announced a 6.5% price increase effective March 7th.

- Marvin Windows and Doors lead times on the Elevate Collection is 15-16 weeks, Essential Collection is 15 weeks, and Signature Collection is 17-18 weeks.

- Ply Gem lead times have improved, but are still extended. 1500 Series Single Hung is 10 weeks, and the Pro Classic Double Hung is 6 weeks. They have announced a price increase of 5-10% effective March 11th.

- Simonton’s lead time is 6 weeks on the new construction series and 3 weeks on the replacement series. They have also announced a price increase of 5-10% effective March 11th.

- Silver Line lead time is 9 weeks on single hung and 6 weeks on double hung. They have also tested and recertified the thermal performance values for several products. For the most recent certified NFRC energy data, click HERE. They have announced a price increase of 5-10% effective March 11th.

- Atrium lead time is 13 weeks on new construction double hung, 12 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series. They have announced a price increase of 5-10% effective March 11th.

- 7-D Windows lead time continues to be 3-4 weeks. Tempered glass units are 12-16 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project. They have announced a 10-15% price increase effective March 7th.

- Wincore has announced a 9% price increase effective April 4th.

GARAGE DOORS:

Lead times are 16 plus weeks depending on style and color selection.

INSULATION:

Insulation continues to be on allocation and supply issues will more than likely continue through this year.

ROOFING:

- EPDM rubber roofing & accessories all have extended lead times, anywhere from 60-120 days depending on the product. EPDM rubber roofing is now on allocation.

- GAF’s supply and color availability continue to be very limited.

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and the full line TAMKO Titan XT.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

SIDING:

- Berger continues to have extended lead times on all coil stock, flashing & roof edge, ranging from 45 to 75 days.

- CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers sales rep for clarification on the availability of your color selection. We are currently out to March 17th with orders. They have also announced a price increase of up to 10% to go in effect on March 14th.

- James Hardie has announced that all shingle siding is on allocation. They’ve permanently discontinued Reveal Panel Systems in both primed and ColorPlus Technology. Click HERE for additional details.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain. Myers is doing everything it can to secure caulking.

- Construction adhesive has been affected by the same constraints as caulking, only worse. One of our main suppliers is not manufacturing adhesive basically because of the lack of raw materials needed for production. Myers has added a new construction adhesive TYTAN Foam. Click HERE to learn more about TYTAN.

EWP:

LP is experiencing extended lead times of 4 plus weeks with limited supply on-hand. They have announced a 2nd quarter price increase effective on shipments received after April 4th. See below. Keep in contact with your sales rep for up-to-date information.

- I-Joists: 20-24%

- LVL: 9-15%

- Rim Boards: 35-38%

- LSL: 10-30%