June Supply Chain Update

We enjoyed catching up with several hundred of you at our Vendor Showcase on May 19th. We had over 50 vendors attend who shared information about products, installation, lead times, etc. Many of you also joined me in a breakout session as we discussed trends in the economy impacting our industry. Thanks for your participation and support of our vendor community.

I’d characterize what we experienced in May as follows: “we are armed on a battlefield in a war on inflation”. As we’ve shared in prior updates, pricing for building products in the aggregate is up 40%ish from pre-pandemic levels. Those inflationary pressures continue for many products into the 2nd quarter of 2022 (see details in our product line update below). The Fed is aggressively using its tools to slow inflation with the understanding that it may even result in an intermediate slowdown in employment (unlikely in the short-term as labor continues to be tight). The financial markets have been highly volatile and down smartly this year as inventors seek to discern the “war on inflation”. The impact in May was felt daily as the markets reacted to commentary on 1st quarter earnings releases and other economic indicators. How do we evaluate the strength of the economy separate from inflation’s impact on financial results?

In an article published May 26 in The Wall Street Journal, Orla McCaffrey reports that mortgage rates have dropped for two weeks in a row, down .2%. While mortgage rates are 2% higher than a year ago, could the two-week decline suggest that one of the battles in the “war” is taking territory. Mortgage refinancing, a large part of the industry’s growth these last two years, has dried up. In addition, entry level buyers who are often transitioning from rental properties and monthly payment focused are fewer in number. Have we found a soft-landing point – it is more realistic historically?

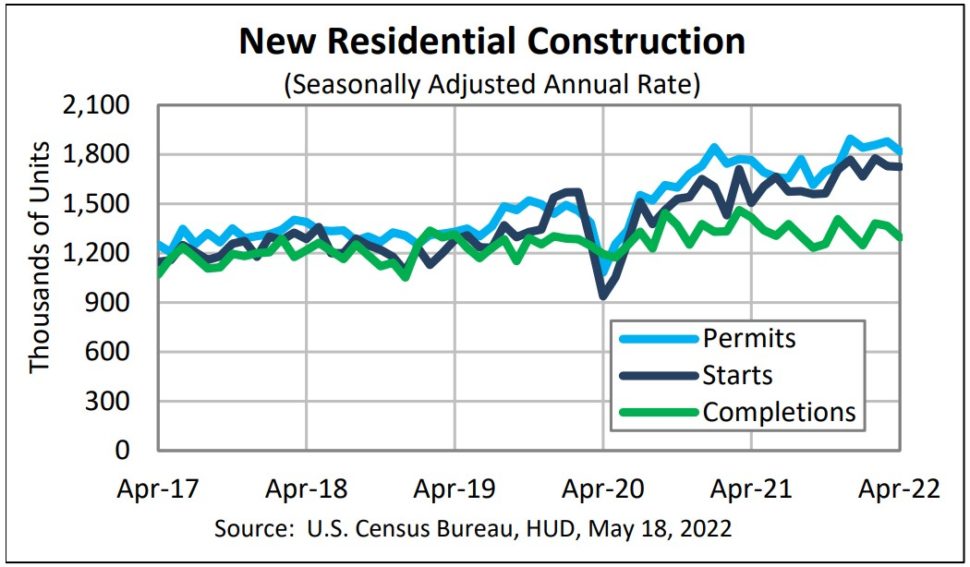

April’s housing report from the Census Bureau posted a slowdown in both Permits & Starts from March, but still growth over April 2021. Multifamily outperformed single-family for the 2nd month in a row. Completions slid backward again, with April’s rate 8.6% lower than April 2021. Redfin’s March housing report shows continued low housing inventory driving home prices 15.5% higher YoY with 10.4% fewer homes on the market than a year ago. Large builders report a slowdown in lead activity, especially for entry level homes, and a slight increase in cancellations. As you may sense from the gap in completions on the chart below, new home completion in 2022 should continue to be steady to strong.

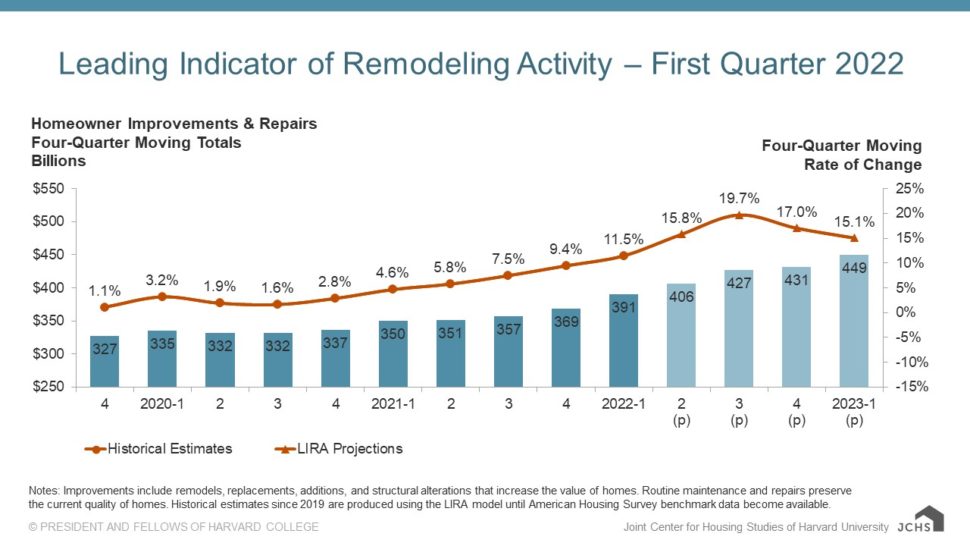

See the chart below from the Joint Study on Housing Studies of Harvard University. Their data suggests that we will experience historical growth in remodeling through much of 2022, but this will slow as we exit the year. John Burns economists report that demand for large project remodeling may continue to be strong due to a homeowner’s inflated value for his property and likely a sub 4% mortgage rate that will stymie a move. Smaller projects that are more sensitive to inflated pricing are more at risk of slowdown.

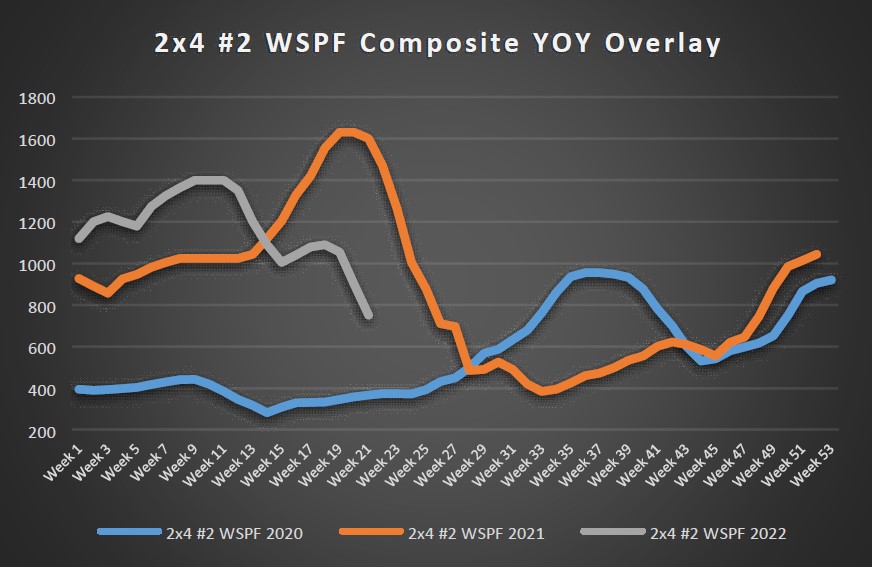

The “war on inflation” is reflected in softening prices for lumber. We reported in our May update that we sensed a possible inflection point in pricing, in that prices had leveled and increased modestly. As we exit May, we’ve experienced a 30% decline in lumber prices over a two-week period. It’s been reported this is due to the decline in new permit/start activity referenced above and the overall uneasiness with the conflicting economic indicators about the future. As reflected above, new construction completion remains steady to strong into the 2nd half of 2022. Could this be another price inflection point for lumber? We’ll see as we publish our July 1 update. Please note – these price declines reflect a point in time buying window for dealers like Myers. It will be weeks before a price decline this dramatic averages down to market levels.

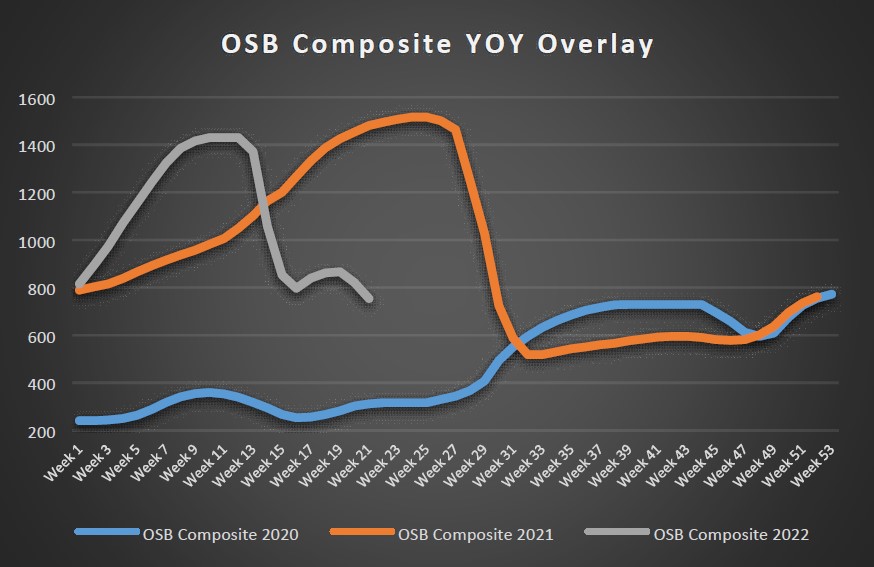

Panel prices have been steady much of May, despite the dramatic decline end of month for lumber. May 26 Random Length panel composite did print down 5% from prior week. Note that the May 26 Random Length panel price is very close to the level we realized through the latter half of 2020.

Product lead times overall generally are slowing improving for wood clad windows, cabinets, siding, millwork, and roofing (see below for specific information by product line). Availability of EWP, rubber roofing and certain glues & caulks remain tight.

In a discussion with one of my friends a few days ago, he referred to his “301k” plan. Due to my puzzled look, he then shared that his balance declined approximately 20%! Our commentary is largely focused on our industry – the war on inflation impacts our overall economy. I’m also sympatric that my reference to war in the context of inflation in no way minimizes the impacts of the real war being waged in Ukraine. Let us hope there is a near term resolution to this conflict.

I enjoy the journey with you and appreciate your partnership with our team.

Regards, Bob Wood, President

P: 717-792-2500 | E: [email protected]

CABINETS:

- Gallery lead times are currently 6-12 weeks. They have announced a price increase of 7.5% effective July 25th.

- Omega / Dynasty lead times are currently 8-12 weeks for framed & inset cabinetry. They have announced a price increase of 5% effective July 15th.

- Legacy lead times are 8-9 weeks. They have announced a price increase of 3% effective June 18th.

- Timberlake lead times are 8-12 weeks. They have announced a price increase of 8% effective July 1st.

- Quality Cabinets lead times are 9-10 weeks. They have announced a price increase of 8% effective July 25th.

- Aristokraft lead times are 12-14 weeks. They have announced a price increase of 7.5% effective July 1st.

- WOLF Cabinetry lead times are 6-8 weeks. They have announced a price increase of 9% effective July 25th.

WINDOWS & DOORS:

- Andersen Windows & Doors lead times on 100 Series are 3-7 weeks, 200 Series are 4-6 weeks, 400 Series are 5-16 weeks, A-Series are 11-13 weeks, E-Series are 26 weeks, MultiGlide are 26 weeks, and folding doors are 21-23 weeks.

- Marvin Windows & Doors lead times on the Elevate Collection is 16-19 weeks, Essential Collection is 18-20 weeks, and Signature Collection is 19-27 weeks.

- Ply Gem lead times have improved, but are still extended. 1500 Series Single Hung is 8 weeks & Pro Classic Double Hung is 3 weeks.

- Simonton’s lead time is 2-3 weeks on the new construction series and 2 weeks on the replacement series.

- Silver Line lead time is 2 weeks on single hung and 2 weeks on double hung.

- Atrium lead time is 6 weeks on new construction double hung, 10 weeks on new construction single hung 150/160 Series, and 8 weeks on SH 130 Series.

- 7-D Windows lead time continues to be 2-3 weeks. Tempered glass units are 12-16 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

- Reeb has announced the following price increases taking effect July 1st:

- Exterior fiberglass & steel doors units – 11-14.5%

- RSP steel fire doors – 6%

- Hollow core doors – 6-14%

- Solid core doors – 8-10%

- Flush doors – 6-20%

- 90 minute hollow metal – 8%

- BWI has announced the following price increases taking effect June 8th:

- Flush & molded slabs & units – up to 15%

- Stile & rail slabs and units – up to 12%

- Exterior steel slabs & units – up to 12%

- Exterior fiberglass slabs & units – up to 12%

- Decorative & standard glass – up to 15%

EXTERIOR TRIM:

- Reeb has announced a 7% price increase on all Fypon products effective on July 1st.

GARAGE DOORS:

- Lead times are 3-16 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue through this year.

ROOFING:

- EPDM rubber roofing & accessories have extended lead times & are on allocation. They have announced a price increase, effective June 1st, on membranes of 6-10% and up to 25% on termination bars, adhesives, cleaners & fastening products.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

SIDING:

- Berger continues to have extended lead times on all coil stock, flashing & roof edge, ranging from 45 to 120 days.

- CertainTeed has returned all suspended vinyl colors back into the market. Myers is currently taking orders for June 16th deliveries.

- LP SmartSide has announced a price increase of 3-5% effective July 4th.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain. Myers is doing everything it can to secure caulking.

- Construction adhesive has been affected by the same constraints as caulking, only worse. One of our main suppliers is not manufacturing adhesive basically because of the lack of raw materials needed for production. Myers has added a new construction adhesive TYTAN Foam. Click HERE to learn more about TYTAN.

HARDWARE:

- Schlage has announced a 10% price increase effective June 25th.

Where do we start? The Awaken Skylight is truly a game changer. Here are just a few of the features we love about this award winner!

• Opens on all 4 sides • Hidden perimeter screen • Dimmable LED lights • Easy control of ventilation, lighting & shading • Low, sleek profile • Wide range of sizes

Click here for more info!

Versatex’s innovative Canvas Series is perfect for porch ceilings, feature walls, outdoor showers & more. Exterior-grade, wood-tone laminates are bonded onto Versatex’s WP4, Stealth Beadboard, 4” Crown or Bed Mould profiles.

The Canvas Series provides the rich look of premium wood in a wide variety of textured, low-gloss finishes. Get the beauty of hardwood with the durability of PVC!

Check out their video here!

Put some money in your pocket with GAF! Now through December 30th, you can earn up to 2.5% back in GAF Rewards Points on your purchases.

You can redeem points for a reloadable prepaid VISA card, retailer gift cards, GAF merchandise, enhanced warranties or even QuickMeasure reports.

Click here to view pdf.