August Supply Chain Update

On July 27, the Fed officials agreed unanimously to lift their benchmark federal-funds rate to a range between 2.25% and 2.5%. “These rate hikes have been large, and they’ve come quickly,” Mr. Powell said, referring to the Fed’s four consecutive rate increases since March. “And it’s likely that their full effect has not been felt by the economy, so there’s probably some significant additional tightening in the pipeline.” The Fed chairman said the slowdown in economic growth during the second quarter had been notable, citing signs of cooling consumer spending, hiring and housing activity. “Are we seeing the slowdown in economic activity that we think we need?” Mr. Powell said. “There is some evidence we are, at this time.” Click HERE for WSJ full article.

I begin our monthly update with the Fed’s announcement, since their battle with inflation remains a consistent theme in the news as it impacts the economy and our industry. Many industries are reporting large swings in demand due to inflation, pandemic related buying patterns, the impact on business from the uptick in covid illnesses and uncertainty in the financial markets. Walmart for example, is discounting many products as inventories have swelled with large swings in buyer behavior. As the WSJ routinely reports, many large retailers and manufacturers are adapting to large swings in demand.

As we discussed in prior months, the combination of inflation and 5.6% mortgage rates have pushed affordability to historical highs. Interestingly, Mortgage News Daily forecasts that the 30-year mortgage rate is unlikely to increase further with the announcement described above, in fact it may decline somewhat. Click HERE to read more. Mortgage volume has declined due in part to qualification issues from entry level buyers.

So, the question that industry economists are then asked is what will the downturn in housing look like – when it will begin, how deep will housing starts decline and how long will it take to recover. In the past few days, I’ve reviewed Zonda’s and John Burn’s insights on these questions. It’s interesting to process their approaches to these topics. They traveled back in time to explore how the economy responded to recessionary initiatives prompted by the Fed and fiscal policy. While none of these historical corrections parallel exactly to the pandemic prompted economic spike in economic activity we’ve experienced, especially in our industry, it helps them provide guidance as we seek to position our businesses for the future.

If you can invest an hour of time, you may enjoy the replay of Zonda’s July 27th National Housing Market Update HERE. They shared that leading indicators for new housing starts nationally are declining smartly over the last few months, especially for SF homes. The MF market remains solid for now since the rental market is strong as entry level buyers are forced to sit on the sidelines for now. Their analysis suggests that national housing starts will return to 2019 levels over a 2-year period. Home prices will decline with swings in demand, increased availability of existing home inventory and construction designs aligned to affordability. They were careful to highlight that these conclusions are in the aggregate for the country. There are some large variances by major metro and geographic region. Some markets that grew materially due to pandemic related factors could see corrections commensurate with this growth. Our market grew nicely, but nothing like what was experienced in these larger metros. Your volume with us in the aggregate has been steady thus far. We together are subject to the same macroeconomic factors, so our leading indicators will likely trend lower as we exit 2022 into 2023.

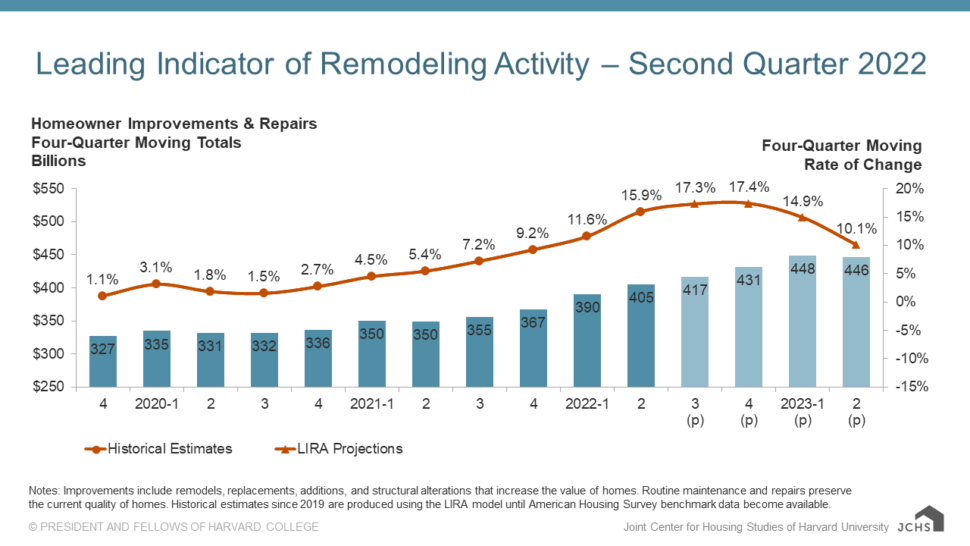

R&R activity continues to be steady and show strength. In a July 19 publication the Joint Center for Housing Studies of Harvard University reported that: “While beginning to soften, growth in spending for home improvements and repairs is expected to remain well above the market’s historical average of 5 percent,” (for the remainder of 2022) says Abbe Will, Associate Project Director of the Remodeling Futures Program. See the chart below.

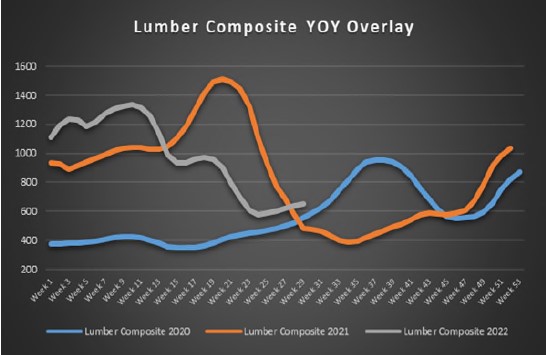

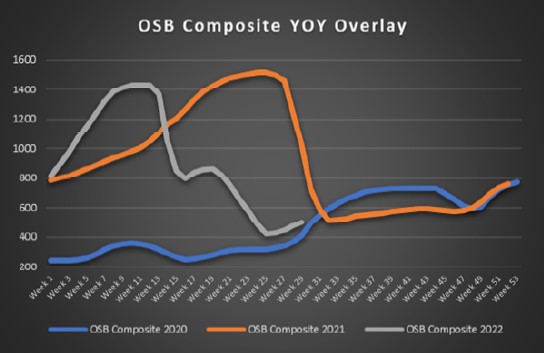

Let’s transition to an update on the lumber/panel markets. In July, we experienced one of the smallest absolute changes in pricing than we’ve had for some time. Demand has been steady for both lumber and panels. After the large downward correction in pricing, we experienced over the last 90 days for these products, both increased in July between 10% and 13%. While this may be perceived as a large relative change in the month, the price change per thousand is small relative to the absolute monthly declines we’ve been experiencing. As we’ve discussed for many months, the industry is still working to complete the high level of permitted homes that are in the pipeline. Transportation continues to add to cost due to fuel prices, shortage of drivers and Covid related illnesses.

As you’ll note in our product line update below, the number of price increases published by our vendors is fewer than in prior months, but a few, like roofing and doors, are large. Lead times for windows, cabinets, and garage doors continue to be extended. Other lead times are showing signs of improvement.

I enjoy having the opportunity to “grab coffee” with you monthly via these updates. The economic study I referred to you above suggests we may experience more change together. Over the last two years, we’ve worked together to adapt to change rather well – 4 months plus to get wood clad windows and cabinets! I’d welcome your insights too. Please connect as you feel compelled.

Blessings,

Bob Wood, President

E: [email protected] P: 717-792-2500

CABINETS:

- Gallery lead times are currently 6-12 weeks.

- Omega / Dynasty lead times are currently 8-12 weeks for framed & inset cabinetry.

- Legacy lead times are 8-9 weeks.

- Timberlake lead times are 8-12 weeks.

- Quality Cabinets lead times are 2-3 weeks. Quality Woodstar lead times are 8-9 weeks.

- Aristokraft lead times are 12-14 weeks.

- WOLF Cabinetry lead times are 6-8 weeks.

WINDOWS & DOORS:

- Andersen Windows & Doors lead times on 100 Series are 5-11 weeks, 200 Series are 2-4 weeks, 400 Series are 3-15 weeks, A-Series are 10-12 weeks, E-Series are 9-11 weeks, MultiGlide are 15-18 weeks, and folding doors are 20-22 weeks.

- Marvin Windows & Doors lead times on the Elevate Collection is 18 weeks, Essential Collection is 20-21 weeks, and Signature Collection is 18-27 weeks.

- Ply Gem lead times have extended to 10 weeks for 1500 Series Single Hung & 5 weeks for Pro Classic Double Hung.

- Simonton’s lead time is 2-3 weeks on the new construction series and 2 weeks on the replacement series.

- Silver Line lead time is 2 weeks on single hung and 2 weeks on double hung. Black & bronze color coated are an additional 6-8 weeks out.

- Atrium lead time is 6 weeks on new construction double hung, 10 weeks on new construction single hung 150/160 Series, and 8 weeks on SH 130 Series.

- 7-D Windows lead time continues to be 2-3 weeks. Tempered glass units are 12-16 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

- Reeb has announced a price increase on Simpson and Woodgrain Doors effective August 1st:

- Simpson exterior doors – 8%

- Simpson interior doors – 10%

- Simpson interior door units – 2.5%

- Woodgrain interior doors – 10%

- Woodgrain interior door units – 6%

MILLWORK:

- Durawood has announced a price increase of 3% on all products effective on August 4th.

GARAGE DOORS:

- Lead times are 8-12 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue through this year.

ROOFING:

- EPDM rubber roofing & accessories have extended lead times & are on allocation.

- GAF has announced a price increase of 7 to 10% on all residential roofing products effective August 1st.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

- TAMKO has announced a price increase of 7 to 10% on all residential roofing & waterproofing products effective July 25th.

SIDING:

- Berger continues to have extended lead times on all coil stock, flashing & roof edge, ranging up to 8 weeks.

- CertainTeed has returned all suspended vinyl colors back into the market. Myers is currently taking orders for August 11th deliveries.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain. Myers is doing everything it can to secure caulking.

- Construction adhesive has been affected by the same constraints as caulking, only worse. One of our main suppliers is not manufacturing adhesive basically because of the lack of raw materials needed for production. Myers has added a new construction adhesive TYTAN Foam. Click HERE to learn more about TYTAN.

HARDWARE:

- Simpson Strong-Tie has announced a price increase effective August 15th on Strong-Wall’s, fasteners, anchors & adhesives.