August Monthly Update

SUPPLY CHAIN, PRICING, PRODUCT UPDATES:

Who would have thought that lumber prices would follow COVID-19 as a hot topic and discussed daily by national and business news media? For months, everyone within the supply chain, from homeowners to suppliers like us, were clamoring for lumber and panels. The unexpected increase in demand resulted in materials shortages and sent pricing through the roof. As mills begin to catch up with the building pace and the demand for lumber and panels steadies, prices are beginning to fall drastically.

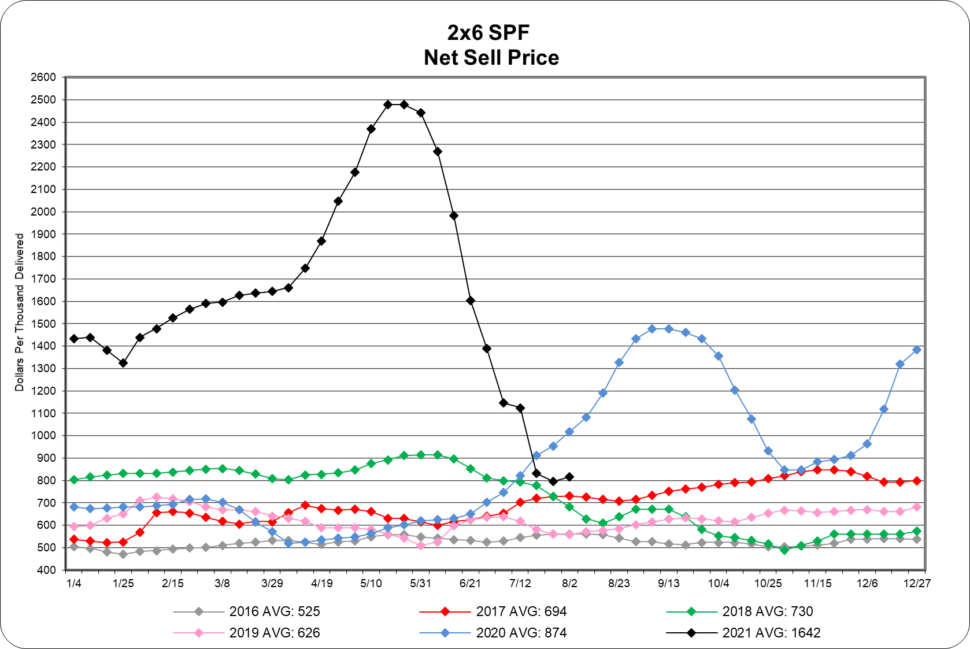

Below are 2 charts that show historical price trends for commodity lumber (2X6X8 Spruce) and panels (15/32” OSB). Lumber prices have declined 66% in the last 8 weeks. What we, internally, refer to as “replacement cost” for lumber is now tracking at pre-pandemic levels. We anticipate less pressure over the next few weeks as the box stores are reported to be purchasing less inventory and those in the distribution channel are trying to turn inventories faster.

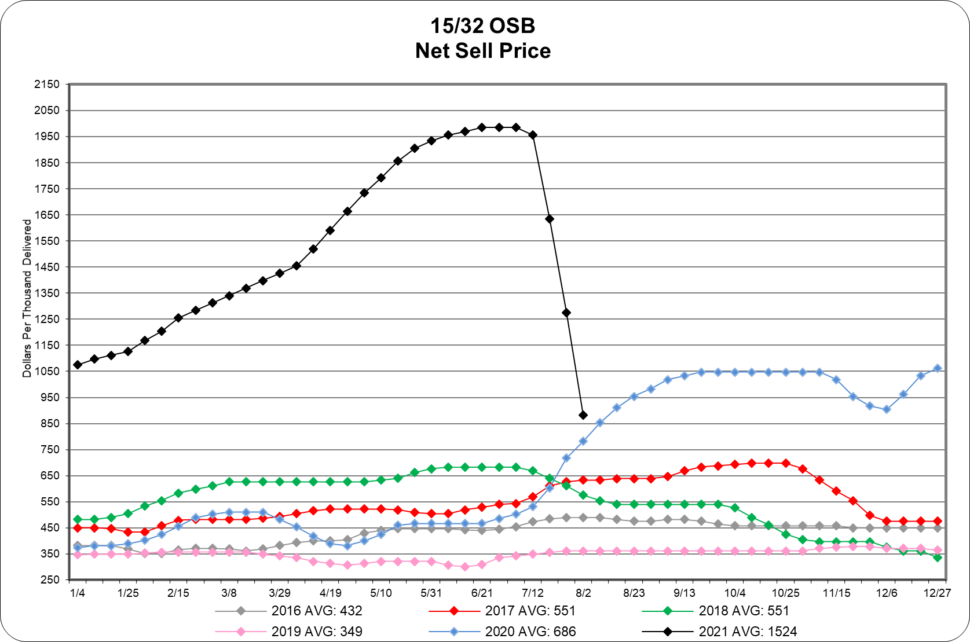

Panels prices have dropped 45% in the last 3 weeks, at a sharp rate of decline. Many of the same macro factors are driving this. It’s possible that the price floor for panels may not be quite as low as pre-pandemic levels since sheet goods are limited by manufacturing capacity and raw material costs, especially resin.

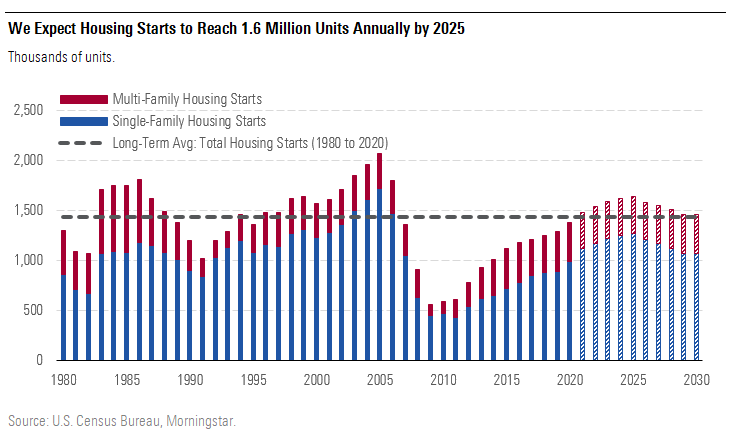

As the chart below illustrates, economists are forecasting that national housing starts will continue to grow over the next few years. The annual, long-term average over the past 40 years was approximately 1.5 million. Economists believe starts will ramp up above this long-term average for the next few years. Note that the supply chain in the early 2000’s supported much higher levels of production. This was sidelined during the recession. Based on forecasts, the lumber market may soon find a price floor.

We are working diligently to turn over our inventory and provide these products at much-reduced prices. Our location managers and sales reps are constantly updated on this historic price and supply chain pyramid. Please feel free to contact me directly if you’d like to brainstorm about how to position all these changes in your quotes for future business.

See below for a summary from several other vendors who have recently announced price increases and/or advised of longer lead times. Shortages of key raw materials and labor are the key influences of these changes. We hope you find this update beneficial as you engage in discussions with customers about upcoming projects. Hopefully the correction in the lumber/panel market will eventually slow or influence pricing for other product lines that have also increased smartly in price since the pandemic.

Thanks for your partnership with Myers.

Regards, Bob Wood

P: 717-792-2500 | E: [email protected]

CABINETS:

Lead Times & Price Increases:

- Gallery lead times have extended to 17 – 18 weeks.

- Omega / Dynasty lead times have extended to 18 weeks.

- Legacy lead times have extended to 5 – 7 weeks.

- Timberlake lead times have extended to 12 – 14 weeks.

- Quality Cabinets lead times have extended to 9 – 10 weeks.

- Aristokraft lead times have extended to 9 – 10 weeks. They have announced a price increase of 6.5% effective August 9th.

- WOLF Cabinetry lead times have extended to 6 – 8 weeks. Contractor’s Choice Cabinetry will have a 6.5% price increase effective August 9th.

FLOORING:

Price Increases:

A significant increase in the cost of raw materials, freight, and labor cost are causing several price increases from flooring companies.

- Mohawk has announced a price increase of 6%-10% effective August 14th.

- Shaw’s price increase of 10% went into effect August 2nd.

- Mannington has announced a price increase of 6%-10% on LVT, select hardwood collections, and sheet goods and a 15% increase on adhesives and sundries effective August 9th.

CEILINGS:

Price Increase:

- Armstrong has announced a price increase of 10% on all ceiling grid effective August 5th and a 11% increase on tile effective August 16th.

DECKING & ACCESSORIES:

Price Increases:

- Trex’s price increase of 8% on all products went into effect August 1st, except for Enhance Natural, which increased by only 1%.

- RDI Rail’s price increase of 4%-15% on railing and 3%-20% on Outdoor Accents went into effect August 2nd.

MILLWORK:

Price Increases:

- BWI has announced a price increase on all hollow core & stile and rail doors of 6-14% effective August 23rd, solid core doors of 2-10%, and exterior steel & fiberglass of 15-19% effective August 23rd.

- Reeb has announced the following price increases effective August 2nd:

- Therma-Tru – 9%

- Exterior wood doors – 3%

- HB&G will increase 10% with the following exceptions:

- PermaPost – 15%

- Aluminum – 25%

- PermaSnap & PermaWrap – 25%

- Wood columns – 25%

- All other wood products – 25%

- Huttig / BenBilt’s price increase of 7.5% on Therma-Tru doors went into effect on July 31st.

- Metrie – the following price increases went into effect on August 2nd:

- Primed Pine: 8%-10%

- Primed small profile trim: 15%-20%

- MDF: 10%-12%

- Solid Pine: 10%

- Poplar: 10%

- Oak: 5%

- Hemlock and Fir: 10%-12%

WINDOWS & DOORS:

Lead Time & Price Increases:

- Andersen Window lead times on 100 Series is at 10 weeks, 200 Series is at 3 weeks, 400 Series is at 3 weeks, and A-Series is at 5-6 weeks. Patio door lead times on 100 Series is at 8 weeks, 200 Series is at 7 weeks, and folding doors are at 13-14 weeks.

- Marvin Doors and Windows lead times on Elevate Collection is at 10-11 weeks, Essential Collection is at 9-10 weeks, Signature Collection is 23 weeks.

- Ply Gem continues to have extended lead times. 1500 Series Single Hung are 39 weeks, and the Pro Classic Double Hung are 18 weeks. They have announced a 15% price increase effective August 31st.

- Simonton’s lead times are 14 weeks on new construction series and 10 weeks on replacement series. They have announced a 15% price increase on new construction and a 6% price increase on replacement effective August 31st.

- Silver Line lead times are 6-9 weeks on single hung and 3 weeks on double hung. They have announced a 15% price increase effective August 31st.

- Atrium lead times are 6 weeks on new construction double hung, 11 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series. They have announced a 15% price increase effective August 31st.

- 7-D Windows lead times have reduced to 3 weeks. Tempered glass units are 4-6 weeks. Contact your sales rep if should these lead times enable a quick turn project.

GARAGE DOORS:

Lead times are 12-16 weeks depending on style and color selection. Haas’s price increase of 16% went into effect July 28th.

LUMBER:

Mill curtailments, wildfires, and mill shutdowns may support the lumber market finding a bottom. On the other hand, slower construction activity, job delays, and a decline of DIY projects has had the opposite effect. Overall market swings have everyone wondering what price level this market will finally settle into. The chart above certainly lends itself to strong housing starts over the next few years.

PANELS:

Sluggish demand has prompted both OSB and plywood prices to tumble over the past 3 weeks. Some would say this correction was long overdue but when you have a market that is outperforming mill production, supply and demand takes over the market. Like the lumber market, panels are looking for a comfortable trading level.

INSULATION:

Insulation continues to be on allocation and supply issues will more than likely continue into the fall.

ROOFING:

Lead Times & Price Increases:

- We are experiencing extended lead times on coil stock, roof edge, and flashing products.

- GAF’s price increase of 4-7% increase will be put into effect on August 30th. Supply and color availability continue to be very limited. They have also announced several discontinuations:

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and we are expanding our TAMKO Titan XT line from 6 to 10 colors as available.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

- WeatherBond’s price increase of 5%-10% on rubber roofing & accessories went into effect August 2nd.

SIDING:

CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers sales rep for clarification on the availability of your color selection.

All CertainTeed products are on allocation, and we are experiencing extended lead times. We are currently out to August 23rd with orders.

EWP:

LP is on allocation and is experiencing extended lead times. Keep in contact with your sales rep for up-to-date information.

HARDWARE:

Since March 2020, steel prices are up a staggering 215% due to manufacturers grappling with a severe raw material shortage. Industry experts do not believe we’ve hit the peak and anticipate prices to remain elevated into 2022. As you can imagine, our fastener vendors are feeling the pain and have had to extend their lead times and implement price increases.

- Simpson Strong-Tie has announced a price increase of 14% effective August 16th.