April Supply Chain Update

Inflation continues to be the core message impacting our economy and industry. Inflation at 7.9% is at a 40-year high and isn’t showing signs of declining. The impact of the war in Ukraine has added inflationary pressure since Ukraine and Russia were both a part of our global economy. The war and the sanctions against Russia due to the war have raised prices for grain, oil and other commodities. Oil, as an example, is a part of the recipe for the manufacture of asphalt roofing.

The Federal Reserve is moving aggressively to slow inflation. It has given guidance that it may raise the federal funds rates 7 times in 2022. The objective is to steer inflation back into an acceptable range of 2-3%. As I listened to Zonda’s Chief Economist, Ali Wolf, during her March 23 Economic Update, she explained that the Fed is purposed on reducing inflation without slowing economic growth. Inflation without growth, known as stagflation, is a potential negative consequence. She shared that the Fed’s focus is to steer inflation with the result of a “soft landing”, an economy with growth and a reasonable level of inflation. As complex as the supply chain is for our industry, I’ll quickly sign up to tackle our issues rather than the complexity of steering inflation.

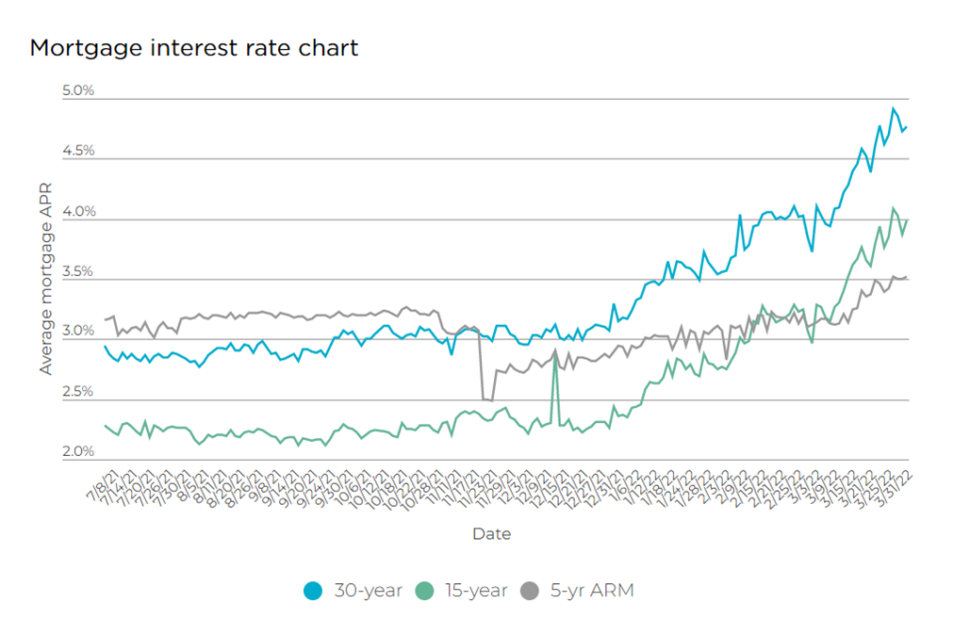

This inflationary impact on our industry in March was material. Affordability for potential home buyers was impacted by both higher material input prices and a large increase in mortgage rates. In our January 1 update, I shared that economists were predicting that the 30-year interest rate could increase to 3.6% in 2022. It increased that much in January alone. Comparable rates for the end of March show 30-year rates approaching 4.8%. As I’ve shared in prior monthly reports, the 30-year mortgage rate correlates closely with the 10-year treasury rate. Ali Wolf shared that treasury rates are increasing as the buyers of these securities are seeking higher yields in consideration of the overall economic backdrop. A 1.5% increase in the 30-year mortgage rate, presuming the buyer pays the same monthly amount, reduces his buying power by $65,000. Zonda also reported that builders continue to increase prices for their homes due to higher input costs for materials and labor. As I began this paragraph, home affordability in 2022 has changed dramatically.

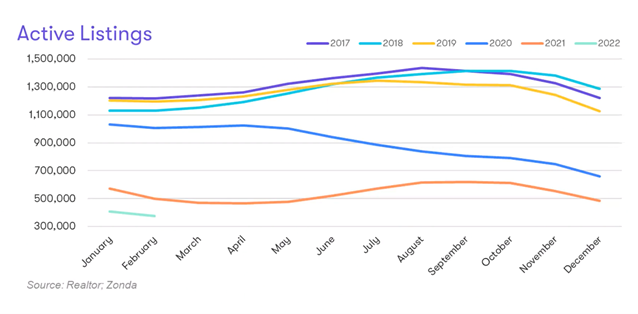

Considering these factors, why is the industry still busy? In March, I had the opportunity to listen to Ali Wolf of Zonda, as I referenced above, and John Burns, the founder of John Burns Real Estate Consulting. Industry economists remain bullish for single family and multifamily construction. In last month’s update, we referenced the backlog in completions versus new permits due to supply chain constraints. We’ll call this pent-up demand. Demand in the short term is also inflated as buyers attempt to lock in rates due to the rapid growth in mortgage rates explained above. This is in addition to the usual demand folks have in buying an entry level or move up home, and they can’t find existing options (see active listing level for 2022 versus history). Finally, the large increase in equity market valuations over the last two years enables move up and 2nd home buyers to purchase real estate. It supports both a change in lifestyle and a diversification of wealth. As I muse over the confluence of these insights married against the Fed’s desire to stymie inflation, one might believe there is an inflection point where demand and pricing moderate. We’ll watch it together.

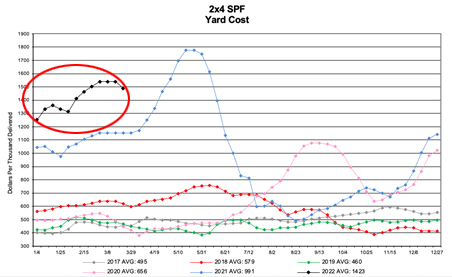

The lumber market has shown a modest weekly decline in March. The April 1st Random Length update was down 8% from the prior week level. We believe these deaverages are in part due to improved availability of transportation as we exit the winter months. We understand that demand from DIY traffic at boxes has been down due to higher prices. As your supplier, our sources for lumber have reasonable availability while demand remains steady. As with any time a commodity hits an inflection point, there has been a lot of volatility. The graph below reflects the futures market for lumber in 2022. Notice the high level of volatility, even this week. We cannot predict where this will go, other than to reference the trend since our last update.

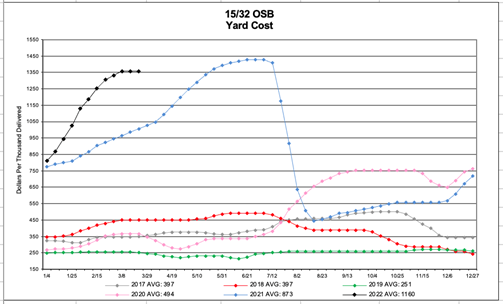

Pricing for panels (OSB and related) is also moderating. To date, we haven’t experienced the pace of decline we describe above for lumber. Availability of panels has improved somewhat since the beginning of the year. We still encourage you to give us advance notice if you have a large project requiring panels.

In our commentary below, we’ve provided information about lead times and price increases for you to be aware of in quoting and managing your projects. A few notes this month include:

- Another large increase in EWP. This results from large increases in material input costs for these manufactures and the limited overall capacity for EWP relative to demand.

- Aluminum clad windows and doors. Andersen and Marvin both have considerably long lead times for aluminum clad products as they grapple not only with increased prices for raw materials (especially metal), but also the lack of availability.

- Asphalt Roofing – all major manufacturers announced another round of increases, due in part to increasing raw material inputs (oil was referenced above). Availability of the full pallet of colors remains limited for a few of these manufacturers.

- Caulking and glues – we strive daily to source these products

Using an analogy of a mountain as a picture of the energy required to do business in the post pandemic industry, it still feels to me like we are climbing in and around the mountain tops. I believe we’ve “acclimated” from the pressures of limited oxygen (pricing/availability), but I believe we are ready for the descent. My sense is that inflation may keep us up here for a while longer. I look forward to celebrating at base camp; I’m not sure when to put that on my calendar.

Regards, Bob Wood, President

P: 717-792-2500 | E: [email protected]

CABINETS:

- Gallery lead times are currently 6-12 weeks.

- Omega / Dynasty lead times are currently 8-12 weeks for framed and inset cabinetry. Full access cabinetry lead times are 18-22 weeks. Omega has announced a 10% increase effective April 11th, along with a 1.5% fuel surcharge.

- Legacy lead times are 7-8 weeks.

- Timberlake lead times are 8-12 weeks.

- Quality Cabinets lead times are 9-10 weeks.

- Aristokraft lead times are 20-22 weeks.

- WOLF Cabinetry lead times are 6-8 weeks. They have also announced a 10% increase on their WOLF Classic line effective April 25th.

FLOORING:

- Mohawk has announced a price increase of 4-6% increase effective May 9th and also have freight increases that will go into effect on April 4th.

DECKING:

- AZEK / TimberTech has announced a price increase of 5-9% on deck and porch products. Railing products will be increasing 4-13%. Price increases will go into effect on April 1st. In addition, AZEK is implementing a 6-13% surcharge on all exterior products (trim, molding, sheets, etc.) that will go into effect on orders placed after April 1st.

WINDOWS & DOORS:

- Andersen Window lead times have become complex and will change on a day-to-day basis. Basic options can add to the lead times on all window lines making it impossible to give estimated lead times on various window lines at this time. To determine the lead time all options and selections will have to be made before Andersen can establish the lead time for the order. Andersen E-Series window lead times are out 52 weeks due to material shortages.

- Marvin Windows and Doors lead times on the Elevate Collection is 17-19 weeks, Essential Collection is 17-18 weeks & Signature Collection is 19-26 weeks. They have also announced a price increase of 7% on Signature, Elevate, and Skycove. The Essentials collection will be increasing by 10%. All increases go into effect on April 1st.

- Ply Gem lead times have improved, but are still extended. 1500 Series Single Hung is 8 weeks, and the Pro Classic Double Hung is 4 weeks.

- Simonton’s lead time is 2-3 weeks on the new construction series and 2 weeks on the replacement series.

- Silver Line lead time is 5 weeks on single hung and 2 weeks on double hung.

- Atrium lead time is 13 weeks on new construction double hung, 13 weeks on new construction single hung 150/160 Series, and 17 weeks on SH 130 Series.

- 7-D Windows lead time continues to be 3-4 weeks. Tempered glass units are 12-16 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

- Wincore has announced a 9% price increase effective April 4th.

- Larson has announced a 6.5% price increase effective April 4th, due to increased cost of labor, delivery increases and raw materials.

- MI Doors has announced the following price increases effective May 1st:

- Interior doors – 20%

- Exterior doors – 25%

- Aluminum & steel commercial doors & frames – 15%

- Millwork, pre-hanging/machining & pocket frames – 17%

GARAGE DOORS:

- Lead times are 10-14 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue through this year.

ROOFING:

- EPDM rubber roofing & accessories all have extended lead times, anywhere from 60-120 days depending on the product. EPDM rubber roofing is now on allocation.

- GAF has announced a price increase of 8-10% on all roofing shingles and accessories effective on shipments starting April 11th. Their supply and color availability continue to be limited.

- TAMKO has announced a price increase of 8-12% on all residential and waterproofing products effective April 4th. We stock Heritage and Titan XT shingles.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

SIDING:

- Berger continues to have extended lead times on all coil stock, flashing & roof edge, ranging from 45 to 120 days.

- CertainTeed has announced their plan to return all suspended vinyl colors back into the market. The color reintroductions will occur in 2 phases. Phase 1 – Charcoal Grey, Pacific Blue, Flagstone, Castle Stone and Cypress were made available on March 21st. Phase 2 – orders may be placed beginning April 11th for all the other suspended colors, as well as their new 2022 colors.

- James Hardie has announced that all shingle siding is on allocation. They’ve permanently discontinued Reveal Panel Systems in both primed and ColorPlus Technology.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain. Myers is doing everything it can to secure caulking.

- Construction adhesive has been affected by the same constraints as caulking, only worse. One of our main suppliers is not manufacturing adhesive basically because of the lack of raw materials needed for production. Myers has added a new construction adhesive TYTAN Foam. Click HERE to learn more about TYTAN.

EWP:

- LP is experiencing extended lead times of 4 plus weeks with limited supply on-hand. They have announced a 2nd quarter price increase effective on shipments received after April 4th. See below.

- I-Joists: 20-24%

- LVL: 9-15%

- Rim Boards: 35-38%

- LSL: 10-30%

- In addition to the April 4th price increase, they have also announced a second increase that will go into effect on May 2nd. Freight rates are being adjusted to reflect current conditions which will further impact prices. See below.

- I-Joists: 17-24%

- LVL: 5-8%

- Rim Boards: 15-18%

HUBER ZIP SYSTEM STRETCH TAPE

Quickly flash tricky areas without piecing tape segments together. ZIP System stretch tape uniquely stretches in all directions to easily fit sills, curves and corners with a single piece. Made of a high-performance composite acrylic, ZIP System stretch tape conforms to challenging applications and locks out moisture even over mismatched surfaces. Check out the video to the left and contact your rep to learn more!

METRIE SHIPLAP

Shiplap is all the rage and Metrie makes it easy! Add Metrie shiplap, horizontally or vertically, to ceilings or walls and add texture to any space. Choose between high-quality primed boards ready for painting or pre-painted boards. It’s a no fuss facelift your customers will love! The best part? It’s quick and easy to install which means less time and more money for you. See your Myers sales rep for samples and pricing!

ANDERSEN MODERN & CONTEMPORARY WINDOWS

What everyone thought was a fleeting trend continues to gain popularity—black frames. Andersen’s 400 Series has all the options to create the look your customers want! It’s a top seller for good reason! The 400 Series is available in contemporary and traditional profiles in black for the interior and exterior. You can also select from a variety of grille options, accessories and more. Check out the video on the left & get in touch!