February 2023 Supply Chain Update

For much of the 4th quarter, economists that we follow reported material declines in new permits, connected with the combination of higher prices for new homes and the dramatic increase in mortgage rates from early 2022. Their corresponding outlook for 2023 single family housing starts was down between 10% and 25%. For me, the variance in their forecasts relates to how quickly (and how far) inflation will fall, which in turn enables the Fed to ease its policies to slow the economy.

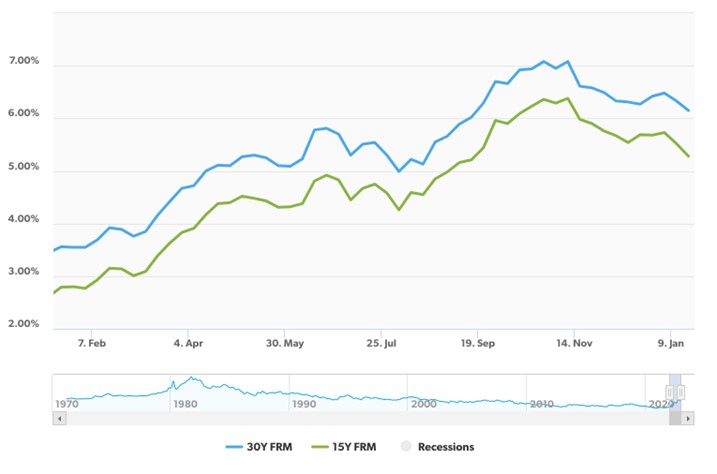

Interestingly, economists now report that lead activity for new housing has improved in 2023 from the decline experienced in the 4th quarter. The improvement has been tagged to a decline in mortgage rates over the last few months and to incentives provided by builders to spur sales. 30-year mortgage rates that approached 7% in late October have declined to 6.1%. 15-year mortgages can be secured in the low 5% range. When builders offer discounts, they are most often using financing incentives in new contracts.

Lance Lampert of Fortune Magazine wrote an article republished on Yahoo, titled “The housing market recession could be bottoming out. What does it mean for home prices?”. Lampert volunteered that sales for both new and existing homes went into free-fall mode [in late 2022], while U.S. home prices started to fall for the first time since 2012. But fast-forward to 2023, and it looks like that free-fall in home sales could be over. In fact, just this week, Goldman Sachs published a paper titled “2023 Housing Outlook: Finding a Trough”. The paper argues that home sales are bottoming out, while the home price correction has a bit longer to run. It went on to say, “We suspect that existing home sales could decline slightly further but will likely bottom in Q1. We expect a peak-to-trough decline in national home prices of roughly 6% and for prices to stop declining around mid-year [in 2023]. On a regional basis, we project larger declines across the Pacific Coast and Southwest regions”.

The article then quotes Ali Wolf, Zonda’s Chief Economist, who offers that the uptick in buyer interest is linked with seasonality, acceptance, and discounts. She shared that builders are experiencing an early spike in seasonal buying that usually kicks off around Super Bowl weekend. They are reporting much higher than expected interest. Consumers acceptance of mortgage rates 1% lower than their peak may reflect the reality that a return to sub 4% rates is unlikely. Finally, she shared that home builder discounts of between 5% and 15% have prompted buyer interest. Click HERE to read Mr. Lampert’s full article, including Ali Wolf’s insights.

What a difference from last month’s update. Most economists expect a slowdown in housing starts and a decline in prices. After all, that was the posture of the Fed’s agenda beginning in 2022 (see last month’s update). The forecast referenced above would suggest the dip in start activity could be as early as the 2nd quarter of 2023. This correction was much later when forecasted in the 4th quarter. Could Goldman Sachs be a bit bullish in their timing? Prices for homes are likely to continue to decline, but shouldn’t be as severe in our market.

In the Myers market, SF permits from January through November 2022 declined 9% from 2021. MF permits were up significantly due to large new projects in the Harrisburg and Hagerstown markets. Overall, new permits for the period were up 24%. Digging a bit deeper, however, we find that permits for the period January through June were up 30%, followed by a decline of 20% in the July through November timeframe. While this doesn’t parallel the 40-60% drops reported in some regions in late 2022, it does show that we are not immune to the macroeconomic influences we discuss monthly.

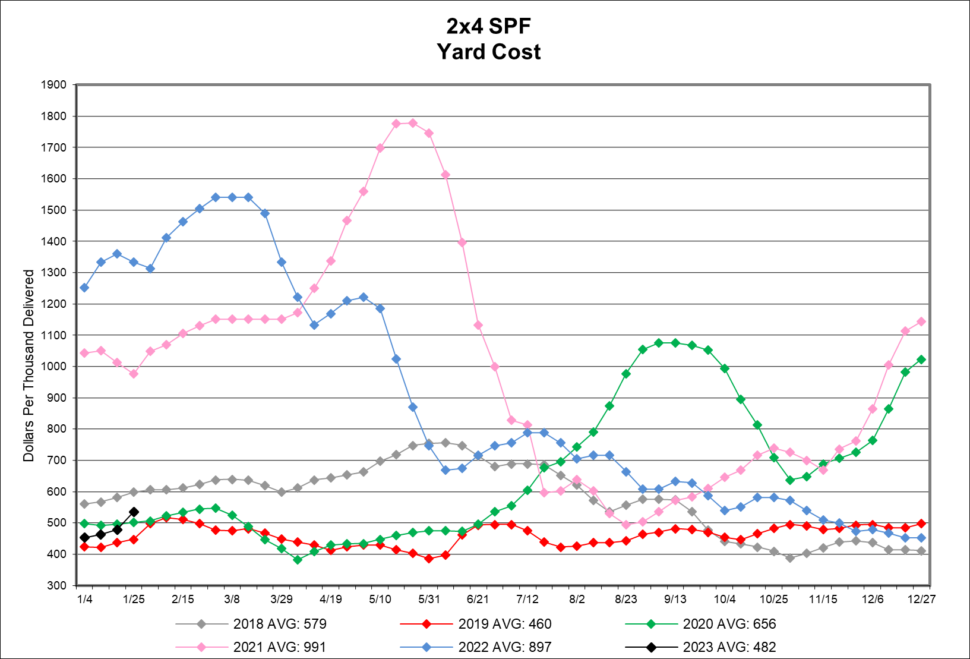

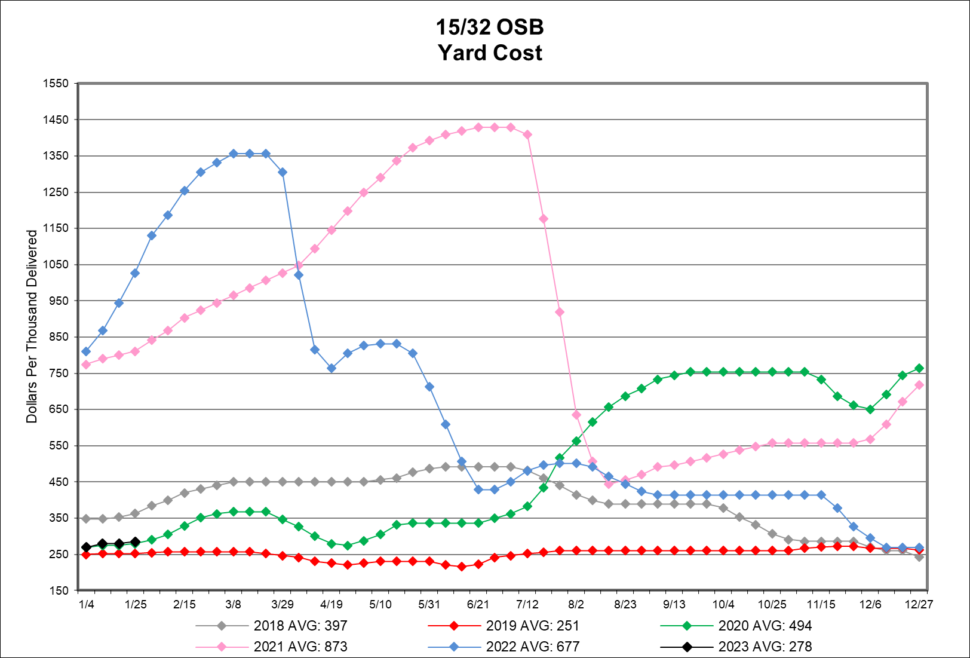

Lumber and panel prices were steady most of January. With pricing at these historically low levels, mills have recently announced curtailments and indefinite closings to align with demand and stabilize pricing. Accordingly, prices have increased as we exit January and supplies of SPF #2 & Btr tightened, especially in the narrows. Moderate corrections will be clearer as supply and demand becomes more balanced. For large projects (especially MF) please connect with us to assure availability and prices.

Regards, Bob Wood, President

P: 717-792-2500 | E: [email protected]

—

CABINETS:

- Gallery lead times are currently 4-6 weeks.

- Omega / Dynasty lead times are currently 9-12 weeks for framed & inset cabinetry.

- Legacy lead times are 4-6 weeks.

- Timberlake lead times are 4-6 weeks.

- Quality Cabinets lead times are 2-4 weeks. Quality Woodstar lead times are 12-13 weeks.

- Aristokraft lead times are 2-4 weeks.

- WOLF Cabinetry lead time is 1-6 weeks.

WINDOWS & DOORS:

- Andersen Windows & Doors lead times on 100 Series are 3-5 weeks, 200 Series are 2-4 weeks, 400 Series are 2-15 weeks, A-Series are 11-13 weeks, E-Series are 15-17 weeks, MultiGlide are 10-12 weeks, and folding doors are 22-24 weeks. Assembled patio doors have extended lead times as well.

- Marvin Windows & Doors lead times on the Elevate Collection is 11-12 weeks, Essential Collection is 6-7 weeks, and Signature Collection is 18-25 weeks.

- Ply Gem lead times are 7 weeks for 1500 Series Single Hung and 4 weeks for Pro Classic Double Hung. As of January 30th, Ply Gem will begin taking orders again for extruded black exterior for all 1500 Series vinyl collection window and doors.

- Simonton’s lead time is 3-4 weeks on the new construction series and 3-4 weeks on the replacement series.

- Silver Line lead time is 2-4 weeks on single hung and 2-3 weeks on double hung. Black & bronze color coated are an additional 3-4 weeks out.

- Atrium lead time is 2 weeks on new construction double hung, 2 weeks on new construction single hung 150/160 Series, 7 weeks for black laminate and 4 weeks on SH 130 Series.

- 7-D Windows lead time continue to be 2 weeks. Tempered glass units are 3 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

GARAGE DOORS:

- Lead times are 4-6 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue throughout the year.

SIDING:

- Myers is currently taking orders for February 16th on CertainTeed siding deliveries. They have also announced several new colors and products to enhance their offering for 2023. Please contact your sales rep for additional details.

CAULKING & ADHESIVE:

- Caulking & adhesive continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain.

HARDWARE:

- Allegion hardware (Schlage, Falcon, Dexter) will have a 5-10% price increase this month.

CHECK OUT THE MOST REALISTIC STONE VENEER ON THE MARKET

Evolve Stone has nailed it with the only mortarless, color-throughout, stone veneer that installs up to 10X faster and is a fraction of the weight compared to the competition. Evolve looks and feels like real stone and installs with the ease of a finish nailer. There’s no mortar or need for engineered tie-backs, grade beams, or stone ledges!

Click HERE to learn more!

WHEN IT’S BUILT RIGHT

IT’S onCENTER!

BlueLinx onCENTER® Framing Systems offer the flexibility to create almost limitless open floor plans in commercial and residential projects. Superior strength and consistent, uniform properties make these products the top choice of building pros.

– LVL Beam & Header

– BLI Joists

– Advanced Framing Lumber

– Rim Board

– Glulam

Check out onCENTER HERE!

NEED A QUALITY WINDOW FAST?

WE CAN HELP!

Seven D. Industries offers vinyl replacement & new construction windows in a variety of styles such as double hung, single hung, picture window, transom, casement, awning, basement hopper, slider & garden windows. Need a special architectural shape? They have those too!

Their windows are manufactured with the latest technology by skilled craftsmen and provide energy efficient comfort, lasting beauty and resilience.

Learn more HERE.