November Supply Chain Update

I acknowledge that our monthly updates are a replay of similar themes, the battle on inflation and the related impact on mortgage rates, which impact new construction. In October 28th’s Wall Street Journal’s front page article headlined with “Mortgage rates topped 7% for the first time in 20 years, the latest milestone in a rapid climb that has all but paralyzed the housing market. The rate on a 30-year fixed mortgage averaged 7.08% this week, according to a survey of lenders by mortgage giant Freddie Mac. Just seven weeks ago, the rate was below 6%. A year ago, it was just over 3%”.

This week, the Fed is projected to increase the Fed Funds rate by an additional .75%. Articles I’ve perused suggest that they are digesting how their earlier actions are impacting the economy. I surmise they are more likely to lessen or defer post November rate increases but intend to go forward with this week’s increase. While mortgage rates will track to the 10-year treasury rate as opposed to the Fed Funds rate, we’ve witnessed how they’ve increased with Fed actions.

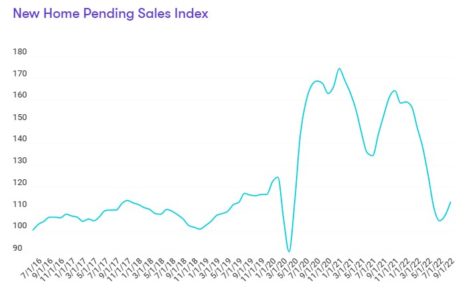

Housing industry economists are increasingly pessimistic about 2023. On October 24th, Zonda reported “The New Home Pending Sales Index, a leading residential real estate indicator based on the number of new home sales contracts signed across the country, came in at 113.2, representing a 25.9% decline from the same month last year. The index is currently 35.0% below cycle highs.” Note that sales index levels have reverted quickly to just below pre–pandemic level. Ali Wolf, Zonda’s Chief Economist shared “We are on a quest to find what we’ll call the strike price – a price where consumers see the value in the home and/or community and re-enter the market.

“Right now, consumers are both uncomfortable with where prices are, and in many cases, unable to make the math work. Strategic price cuts and incentives are sometimes proving effective at pulling back in some of the skittish consumers. In other cases, the quest carries on.” I’ve read several recent industry publications and newspaper articles with similar conclusions. Price levels are likely to decline based on these themes. Click HERE to read Zonda’s September New Home Market Update.

I also watched a Zonda published webinar entitled “Building Product Insights”. The webinar focused on their forecast for remodeling segment. On one hand, many homeowners are more likely to remodel than upgrade to newer homes since mortgages pre-2022 are sub 4%. Zonda’s leading indicators for R&R underpin skepticism about the economy, just like for new construction. Their research dives deeply into homebuyer remodeling forecasts by project type influenced by demographics like age, income level, and size/age of home, etc. For 2023 they forecast that major remodeling may decline by 14% (-8% after factoring in inflation). Other types of projects, after factoring in for inflation, may not vary materially from 2022. Click HERE for a replay of this interesting analysis of the remodeling market.

“Annual gains in improvement and maintenance expenditures to owner-occupied homes are expected to decline sharply by the middle of next year, according to the Leading Indicator of Remodeling Activity (LIRA)” which was released October 20th by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University. “Housing and remodeling markets are undoubtedly slowing from the exceptionally high and unsustainable growth rates that followed in the wake of the pandemic-induced recession,” says Carlos Martin, Project Director of the Remodeling Futures Program at the Center. “Spending for home improvements will continue to face headwinds from declining home sales, rising interest rates, and the increasing costs of contractor labor and building materials.” “Although remodeling market gains are expected to cool significantly next year, homeowners still have record levels of home equity to support financing of renovations,” shares Abbe Will, Associate Project Director of the Remodeling Futures Program. “Energy-efficiency retrofits incentivized by the Inflation Reduction Act of 2022, as well as disaster repairs and mitigation projects following Hurricane Ian will further support expansion of the home remodeling market to almost $450 billion in 2023.” I deemed it worthwhile to share both economist’s perspectives on the remodeling market, considering the slowdown expected. Note that the forecast in the chart above for the 3rd quarter of next year is flat with prior quarters.

It’s difficult for me to unpack how the above trends are impacting our local market. We sense based on your business activity with us that new construction along the 81 corridor remains steady. Multi-family construction and quoting are both busy. Many of you have shared that the pace of lead activity has slowed, but not stopped. Our market isn’t immune to the factors described above but may not be impacted as severely since our growth over the last 2 years, while brisk, wasn’t as crazy as other regions in the country.

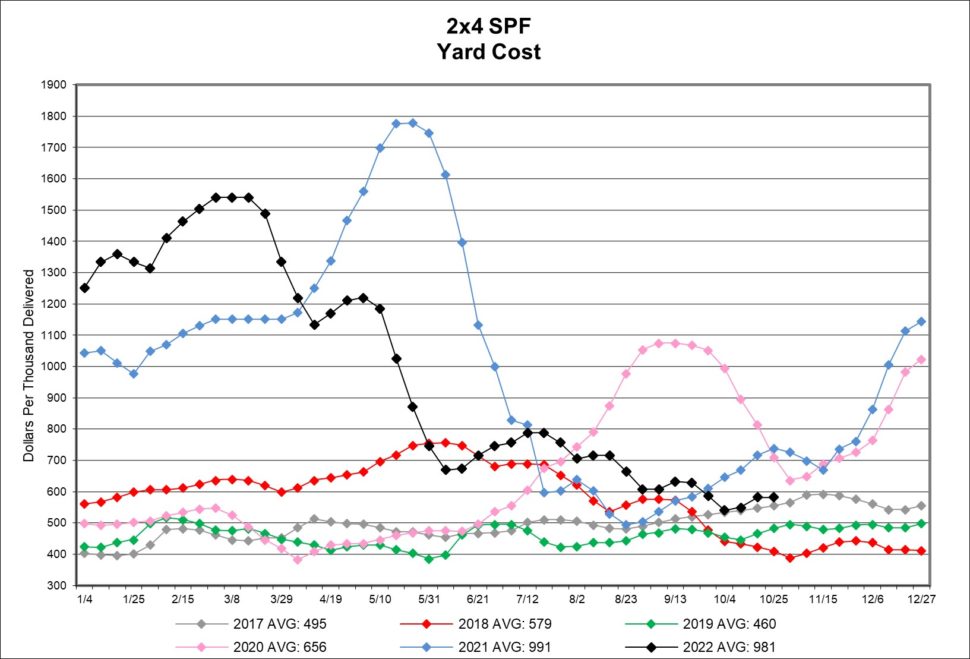

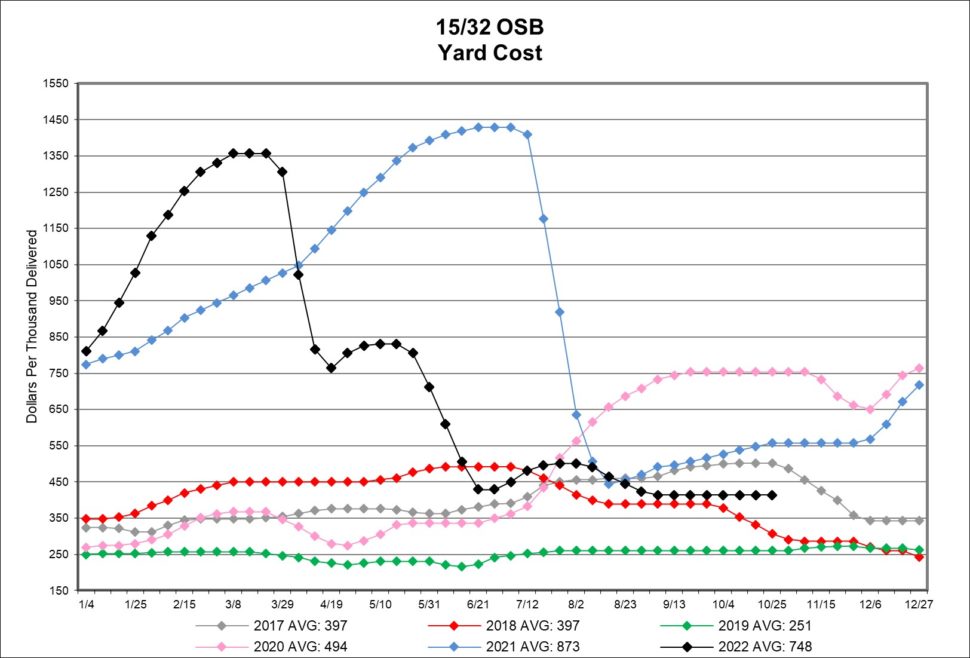

Lumber and panel prices have stabilized, at least on a relative basis, to the last two years. As you’ll note from the charts we always attach, price levels are now at or below historical averages, which reflect manufacturer price thresholds that are required for production. As I shared for the last few months, we anticipate other commodity prices will fall in the coming year. Thus far, we’ve seen softening in fastener pricing.

Supply chain issues continue to be a concern. While several products have returned to normal lead times, lead times for many products are still extended due to raw material shortages, labor shortages, and logistic challenges. Windows, caulking, insulation, clear pine, hardwoods, and pocket door frames continue with long extended lead times (see below).

This update prompts the question – how do we position our businesses for the future in our local markets? We look forward to discussing this with you.

Regards, Bob Wood, President

P: 717-792-2500 | E: [email protected]

CABINETS:

- Gallery lead times are currently 5-9 weeks.

- Omega / Dynasty lead times are currently 5-8 weeks for framed & inset cabinetry.

- Legacy lead times are 8-9 weeks.

- Timberlake lead times are 4-6 weeks.

- Quality Cabinets lead times are 2-4 weeks. Quality Woodstar lead times are 8-9 weeks.

- Aristokraft lead times are 3-5 weeks.

- WOLF Cabinetry lead time is 1-6 weeks.

WINDOWS & DOORS:

- Andersen Windows & Doors lead times on 100 Series are 5-10 weeks, 200 Series are 2-4 weeks, 400 Series are 3-15 weeks, A-Series are 13-15 weeks, E-Series are 9-11 weeks, MultiGlide are 9-11 weeks, and folding doors are 22-24 weeks.

- Marvin Windows & Doors lead times on the Elevate Collection is 12-13 weeks, Essential Collection is 9-10 weeks, and Signature Collection is 18-25 weeks.

- Ply Gem lead times are 8 weeks for 1500 Series Single Hung and 7 weeks for Pro Classic Double Hung.

- Simonton’s lead time is 3-5 weeks on the new construction series and 4 weeks on the replacement series.

- Silver Line lead time is 2-4 weeks on single hung and 2-4 weeks on double hung. Black & bronze color coated are an additional 3-4 weeks out.

- Atrium lead time is 6 weeks on new construction double hung, 5 weeks on new construction single hung 150/160 Series, and 15 weeks on SH 130 Series.

- 7-D Windows lead time continue to be 2 weeks. Tempered glass units are 3 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

FLOORING:

- Garden State Tile has announced a 10% price increase on their import collection effective November 1st. See your sales rep for specific products that will be affected by this increase.

GARAGE DOORS:

- Lead times are 6-8 weeks depending on style and color selection.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue through this year.

- Knauf has announced a 10% price increase effective December 2nd.

ROOFING:

- EPDM rubber roofing & accessories lead times have improved but are still on allocation.

SIDING:

- Myers is currently taking orders for December 1st on CertainTeed siding deliveries. CertainTeed has also announced several product discontinuations. Please click HERE for additional details.

- James Hardie is making adjustments to product availability and lead times to better serve the market. Effective January 3rd, 2023, prices will increase on most Hardie products. Please see your sales rep for up-to-date pricing information.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain.

Therma-Tru Door’s new collections deliver functional style to reflect the latest on-trend looks and meet the unique needs of today’s homeowners. Check out the video above to learn more!

CASUAL HAVEN:

Clean & familiar designs create a calming oasis, inside & out.

RENEWED HISTORY:

Classic architecture infused with fresh energy for an elevated look.

MODERN REVIVAL:

Fresh looks & retro design come together for a softer modern.

There’s a reason Timberlake Cabinetry is pulling rank. Their multiple brands and series make it easy to choose the perfect balance of quality and value for your homebuyers.

– On-trend styles and finishes

– Built-to-order craftsmanship

– Options for custom looks

– Solutions for additional functionality

– Priced right

Timberlake has also expanded their product offering. They’ve introduced new finishes, cabinet sizes, hardware, and range hoods – creating a much more modern finish palette and providing the decorative flourishes that are in high demand. Click HERE to learn more!

Durable, low-maintenance and designed with more glass for grand views, light and open spaces.

The Ultimate Swinging Door was created to help bring the most ambitious visions to life. The 3-inch stiles and rails produce clean lines and a clutter-free aesthetic, and four panels can be combined to produce large openings for grand views. The durable extruded aluminum exteriors will provide years of worry-free protection with luxury looks.

Interested? Contact your sales rep!