September Supply Chain Update

We begin our monthly update with a continuing discussion of the Fed’s motivation to tackle inflation. In a speech on August 26, Chairman Powell shared, “We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent.” He acknowledged that “the U.S. economy is clearly slowing from the historically high growth rates of 2021…. While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down”. Click HERE to peruse his full comments.

The financial markets responded promptly, surrendering approximately 3% of their value. As we discussed last month, the markets seem to be conflicted by a slowing economy, especially for some industries, but largely due to labor shortages. In general, when the economy slows, we’ll see a contraction in the employment market, but we haven’t seen that yet. The war in Ukraine continues to affect oil and gas production and other industries. Our daily news is filled with opinions about the depth of a recessionary correction that could result from the war on inflation. Clearly, we’ve surrendered the economic pace that was influenced by the pandemic. As the economy settles and consumer behaviors normalize, industries that were significantly affected may see a larger correction. Let’s put our seat belts on! It will be an interesting ride.

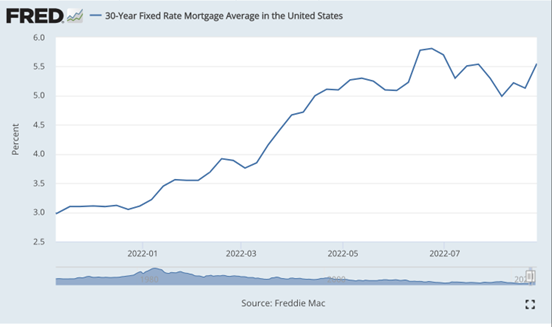

Mortgage rates dropped from their peak of 5.7% in June to a range of 5.0-5.15% in the first three weeks of August. Rates shot up .3% last week in response to the Fed’s announcement and the related economic fears. Mortgage rates fell when the Fed’s increased the Fed Funds rate in July. Maybe the increase we’re experiencing now will be sufficient to accommodate any increase in September, since demand for mortgages is already stymied by today’s rates.

Nationally, new housing sales are reportedly trending at pre-pandemic levels, which are 20-24% lower than we experienced in 2021.

Currently, single and multifamily construction continues to trend at record levels as the industry is working to complete homes that were already in progress. As these two trends collide, influenced by the increase in home costs, home cancellations have spiked, and pricing has stabilized. Economists report home price declines in some markets, especially where inflation and growth were extreme.

Demand for housing remains, which prompts economists to suggest that we could settle at 2019 levels of single-family home construction. Interestingly, economists believe that building material prices beyond lumber and panels could decline beginning in 2023. Many manufacturers have announced that prices will not increase for the remainder of 2022. Please note in the product line update below that there is only one price increase versus the multitude of price increases we experienced monthly much of this year.

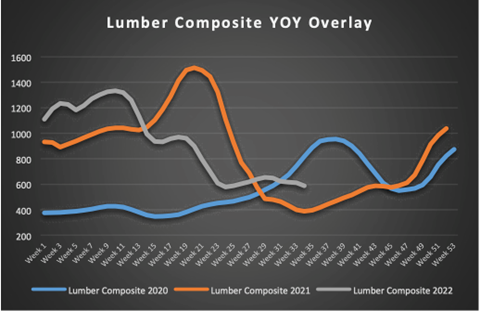

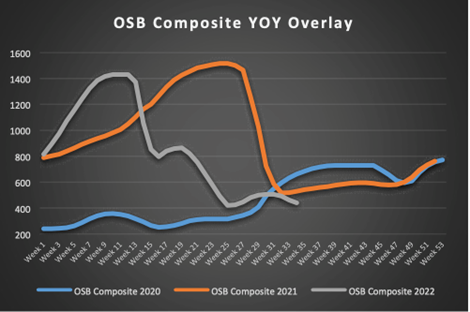

Lumber and panel prices declined this month as manufacturers and dealers align inventory levels with somewhat lower demand forecasts. Considering the pricing cycles shown below, multifamily buyers are also waiting for a time when they believe they can secure the lowest price. The Random Length Future’s market has been reasonably steady since the Fed’s announcement.

Our market’s June single-family new permit activity along the 81 corridor is up a few percent YTD. Multifamily new permits are up materially as well. In aggregating your input, we sense pockets of sluggish demand in both the R&R and new construction sectors. Overall, our level of activity feels stronger than the national housing trends referenced above. Consumers are understandably hesitant to make commitments. The sooner inflationary reports show a smart decline, the better!

Hopefully fall brings some rain and cooler temperatures. I’m sure your job site crews will welcome this change. Thanks for your relationships with our team.

Enjoy your Labor Day weekend!

Bob Wood, President

E: [email protected] P: 717-792-2500

CABINETS:

- Gallery lead times are currently 5-9 weeks.

- Omega / Dynasty lead times are currently 8-12 weeks for framed & inset cabinetry. Omega has also announced several product discontinuations. Click HERE for list.

- Legacy lead times are 8-9 weeks.

- Timberlake lead times are 8-12 weeks.

- Quality Cabinets lead times are 2-4 weeks. Quality Woodstar lead times are 8-9 weeks.

- Aristokraft lead times are 7-9 weeks.

- WOLF Cabinetry lead times are 6-8 weeks.

WINDOWS & DOORS:

- Andersen Windows & Doors lead times on 100 Series are 5-10 weeks, 200 Series are 3-5 weeks, 400 Series are 3-16 weeks, A-Series are 12-14 weeks, E-Series are 9-11 weeks, MultiGlide are 15-17 weeks, and folding doors are 20-22 weeks.

- Marvin Windows & Doors lead times on the Elevate Collection is 16-17 weeks, Essential Collection is 17-18 weeks, and Signature Collection is 18-27 weeks.

- Ply Gem lead times are 9 weeks for 1500 Series Single Hung and 8 weeks for Pro Classic Double Hung.

- Simonton’s lead time is 2-4 weeks on the new construction series and 2-3 weeks on the replacement series.

- Silver Line lead time is 2 weeks on single hung and 2 weeks on double hung. Black & bronze color coated are an additional 3-4 weeks out.

- Atrium lead time is 7 weeks on new construction double hung, 8 weeks on new construction single hung 150/160 Series, and 15 weeks on SH 130 Series.

- 7-D Windows lead time continues to be 2 weeks. Tempered glass units are 3 weeks. Contact your sales rep should these lead times enable you to achieve a quick turn project.

GARAGE DOORS:

- Lead times are 6-8 weeks depending on style and color selection. LiftMaster has announced a price increase effective September 1st of 8-10% on all garage door openers.

INSULATION:

- Insulation continues to be on allocation and supply issues will more than likely continue through this year.

ROOFING:

- EPDM rubber roofing & accessories have extended lead times & are on allocation.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

SIDING:

- Myers is currently taking orders for September 15th on CertainTeed siding deliveries. CertainTeed has also announced several product discontinuations. Please click HERE for additional details.

CAULKING & ADHESIVE:

- Caulking continues to be hard to locate. The lack of raw materials needed to manufacture caulking has put a strain on the supply chain.

- Construction adhesive has been affected by the same constraints, but has been showing signs of slight improvement. We have added a new construction adhesive TYTAN Foam. Click HERE to learn more about TYTAN.

No Website? Website Not Working?

Pricing starts at only $595!

Did you know that 75% of consumers make a decision on a company’s professionalism based on their website? How’s your site look? If you don’t have one or need an upgrade, we have the perfect solution – Your Web Pro! You can have a new site up in a matter of DAYS … not weeks.

- Completely customized

- Personalized product showroom

- Project photo gallery

- Customer reviews & testimonials

- Unlimited management & support

Click HERE to learn more & get started today!

Enclose buildings faster and save time & money with Simpson’s Edge-Tie™

Check out the NEW Edge-Tie System. Now you connect cladding or curtain walls faster & easier. This system uses a unique extruded steel shape & pour/stop combination and provides higher strength & straighter solutions than typical bent plates. It fits any steel building with no height limitations.

- Single attachment points for multiple trades

- Optional quick-release, reusable guardrail & connection system

- Adjustable bolted connection reduces coordination between trades & replaces costly field welding & inspection

- Eliminates anchor layout

Click HERE to learn more.

Need a quality, vinyl window FAST?

We can help!

Seven D. Industries offers vinyl replacement & new construction windows in a variety of styles such as double hung, single hung, picture window, transom, casement, awning, basement hopper, slider & garden windows. Need a special architectural shape? They have those too!

Their windows are designed & manufactured with the latest technology by skilled craftsmen and provide energy efficient comfort, lasting beauty and resilience.

Interested? Learn more HERE.