September Monthly Update

SUPPLY CHAIN, PRICING, PRODUCT UPDATES:

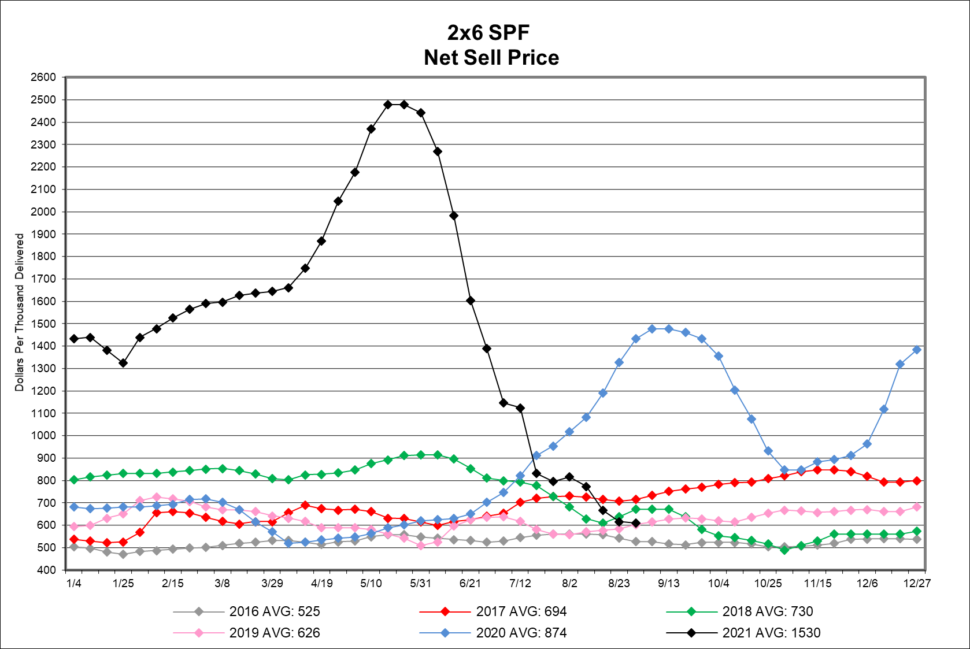

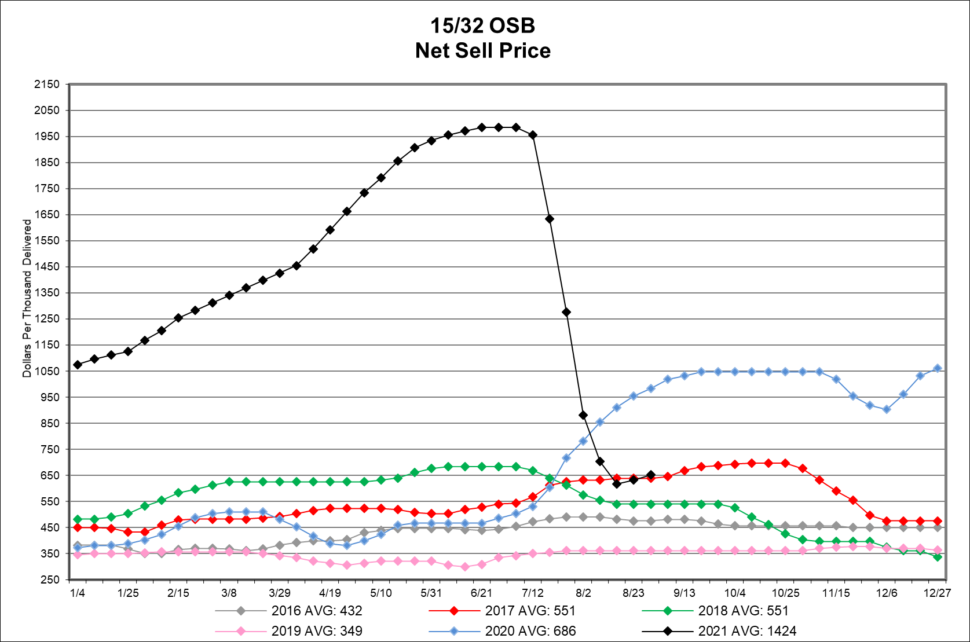

Last month we covered in some detail the factors that influenced the dramatic decline in lumber and panel prices over the last 90 days. As you’ll see from the graphs that follow, prices continued to decline through most of August. The same market influences – buyers waiting for a bottom, the ‘boxes’ postponing buying until late August and the resulting swelled supply chain – prompted the falling prices. Note that pricing has now fallen to pre-pandemic levels.

Will it decline further? We’ve learned not to predict! Rather we’ll amplify one data point. Prices firmed up for both lumber and panels as we exit August. The next question, will we continue to experience wide swings in pricing like we’ve had the last two years? To be selfish, we’d welcome a return to the historical pricing volatility reflected in the charts before the pandemic. Interestingly, all of us in the supply chain have adapted our businesses to these dramatic swings so we’ll figure it out together.

Should we expect that other product lines will also experience price declines? As we are now at the back end of the lumber/panel pricing bubble, an obvious price driver was dramatically increased demand and the resulting extended lead times, etc. Certainly, costs were higher, especially labor and distribution, but not in line with the level of the increases. For manufactured products there are many other variables that do drive increased costs. Labor is likely a larger component of cost, which is impacted by both the pandemic and short supply. As we are a global economy, the complexity of shipping and the impact of the virus across the world is impacting business generally, not just in our industry. Look at car lots for example. Accordingly, we don’t anticipate a material correction in other building products pricing, especially in the short term.

As you’ll see in the detailed commentary below by product line, we continue to receive numerous updates regarding extended lead times and price increases. Some reflect the influences of the variables described above. As we’ve shared monthly, we provide this information for your consideration as you build estimates for upcoming projects as this impacts your costs due to both materials and the time to complete a project.

Just to highlight a few of the product lines covered below:

- One of the large suppliers of EWP has announced that it will exit the business at year end. This capacity will likely be absorbed in some way but is an additional influence on lead times/pricing in this product category.

- Extended cabinet lead times – cabinet manufactures are having a difficult time securing materials in addition to hinges, hardware, etc. Because of the breadth of our product offerings, we will attempt to help you shift between product options where your timing is tight.

- GAF is a market leader in the industry and continues to be a valued partner to Myers. Demand for shingles has caused them to manufacture only 3 primary colors and supply is still limited. Many of our customers have transitioned to TAMKO’s Titan XT as a result. We have 10 colors available in stock.

Thanks for your partnership with Myers.

Regards, Bob Wood

P: 717-792-2500 | E: [email protected]

CABINETS:

Lead Times & Price Increases:

- Gallery lead times have extended to 17 – 18 weeks.

- Omega / Dynasty lead times have extended to 18 – 20 weeks.

- Legacy lead times have extended to 6 – 7 weeks.

- Timberlake lead times have extended to 12 – 14 weeks.

- Quality Cabinets lead times have extended to 9 – 10 weeks.

- Aristokraft lead times have extended to 9 – 10 weeks.

- WOLF Cabinetry lead times have extended to 6 – 8 weeks. WOLF has also discontinued their Contractor’s Choice cabinetry line effective immediately. They will continue to support replacement and warranty parts for up to one year past this discontinuation date.

DECKING & ACCESSORIES:

Price Increases:

- Trex will be increasing prices on November 1st. Resin has increased 12 of the last 14 months, labor issues, and freight cost are leading factors that have caused many of our suppliers to raise prices over the past year.

- AZEK has announced the following increases effective immediately:

- TimberTech / AZEK: 5-10%

- TimberTech Pro: 4-7%

- TimberTech Edge: 5-20%

- All Railing: 4-12%

- AZEK trim, moulding & siding: 14%

MILLWORK:

Price Increases:

- Versatex had a 14% surcharge that was effective immediately due to Resin pricing and many other increases relative to raw material and production cost. Effective September 30th there will be a 7% price increase.

- Reeb has announced the following price increases effective November 1st:

- Flush & Molded Doors: 10-12%

- Primed, Clear & Knotty Pine Doors: 25%

- White Pine Doors: 12%

- Woodgrain Doors: 12%

WINDOWS & DOORS:

Lead Time & Price Increases:

- Andersen Window lead times on 100 Series is at 11 weeks, 200 Series is at 3 weeks, 400 Series is at 3 weeks, and A-Series is at 5-6 weeks. Patio door lead times on 100 Series is at 8 weeks, 200 Series is at 7 weeks, and folding doors are at 15 weeks. Effective September 9th, Andersen will have a 7% price increase on all window & patio door products. Effective October 25th, they will have a 7% increase on all storm door products.

- Marvin Doors and Windows lead times on Elevate Collection is at 11-13 weeks, Essential Collection is at 9-10 weeks, Signature Collection is 23 weeks.

- Ply Gem continues to have extended lead times. 1500 Series Single Hung are 42 weeks, and the Pro Classic Double Hung are 21 weeks. A price increase of 15% went into effect August 31st.

- Simonton’s lead times are 16 weeks on new construction series and 13 weeks on replacement series. A price increase of 15% on new construction and 6% on replacement went into effect August 31st.

- Silver Line lead times are 15 weeks on single hung and 8 weeks on double hung. A price increase of 15% went into effect August 31st.

- Atrium lead times are 6 weeks on new construction double hung, 11 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series. A price increase of 15% went into effect August 31st.

- 7-D Windows lead times have reduced to 3 weeks. Tempered glass units are 4-6 weeks. Contact your sales rep if should these lead times enable a quick turn project. They have announced an 8% price increase effective September 16th.

GARAGE DOORS:

Lead times are 16 weeks depending on style and color selection.

- Haas has announced a 12% price increase.

- CHI has announced a 7% price increase, which includes garage door opens. Effective immediately.

GYPSUM:

There will be a 10% price increase on all Gypsum products effective October 1st.

LUMBER:

Lumber prices continue to fall to pre-pandemic levels, and it appears that we may see an end to the free fall we have had over the past few weeks. Never did the market climb so high and never did the market drop so fast. Managing this market has been a challenge for all of us, to say the least. Housing starts are forecasted to be strong over the next couple of years and all indications are good moving into the 4th quarter and into 2022. Keep in contact with your Myers Rep for updated information.

PANELS:

The prices on OSB and Yellow Pine have settled into a relatively stable range over the past few weeks. All of us are looking for a more stable market moving forward, but it is important to understand what caused the extreme volatile pricing. Everything from a pandemic to labor shortages, remodeling projects from people stuck at home, to high housing starts, low interest rates, shipping issues, resin, and the list goes on. Supply and demand, simply the supply could not keep up with the demand.

INSULATION:

Insulation continues to be on allocation and supply issues will more than likely continue into the fall.

ROOFING:

Lead Times & Price Increases:

- We are experiencing extended lead times on coil stock, roof edge, and flashing products.

- GAF’s price increase of 4-7% increase went into effect on August 30th. Supply and color availability continue to be very limited. They have also announced several discontinuations:

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and we are expanding our TAMKO Titan XT line from 6 to 10 colors as available. A price increase of 1.5% went into effect on August 30th.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

- Berger Products has announced a price increase of 8-10% effective September 7th.

SIDING:

CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers sales rep for clarification on the availability of your color selection. All CertainTeed products are on allocation, and we are experiencing extended lead times. We are currently out to September 23rd with orders.

EWP:

LP is on allocation and is experiencing extended lead times. Keep in contact with your sales rep for up-to-date information.

HARDWARE:

Simpson Strong-Tie has announced a price increase of 12% effective October 18th.