July Monthly Update

SUPPLY CHAIN, PRICING, PRODUCT UPDATES:

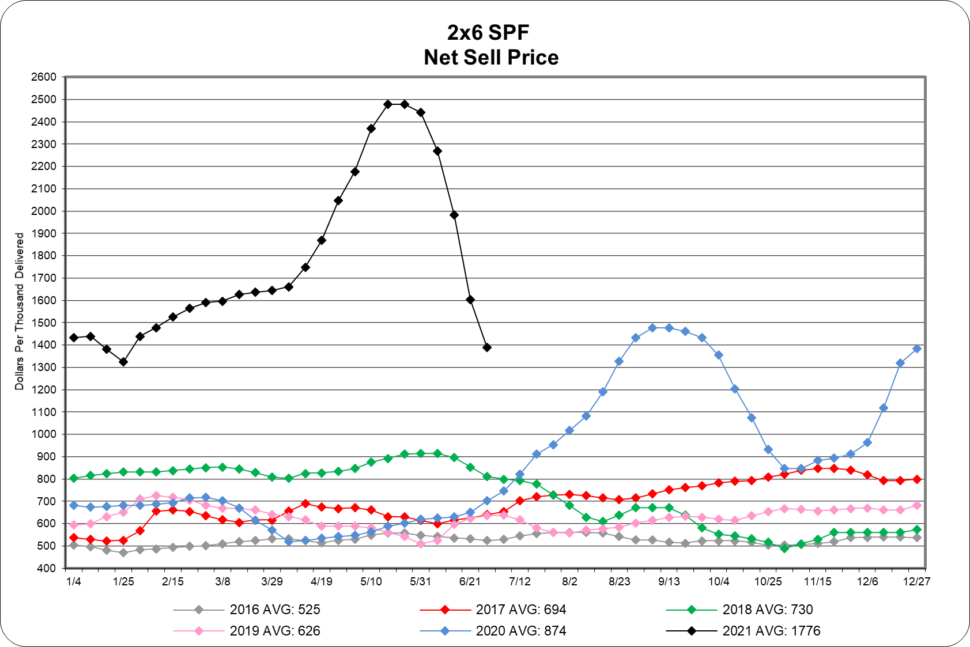

Last month we speculated that lumber would likely peak and slowly retreat based on the continued strength in new construction and remodeling. Over the past 5 weeks, lumber prices at mills have dropped by as much as 48%, which you’ll experience as Myers secures this lower priced inventory. We didn’t anticipate this sharp of a retreat in pricing!

We’ve included a chart below which illustrates the dramatic historical change in lumber pricing from mills. While this is only one product, 2×6 Spruce, it is representative of the changes across this entire category. For the week beginning June 28, prices are continuing to decline but at a slower pace. The intermediate to long term new construction & remodeling forecast remains positive.

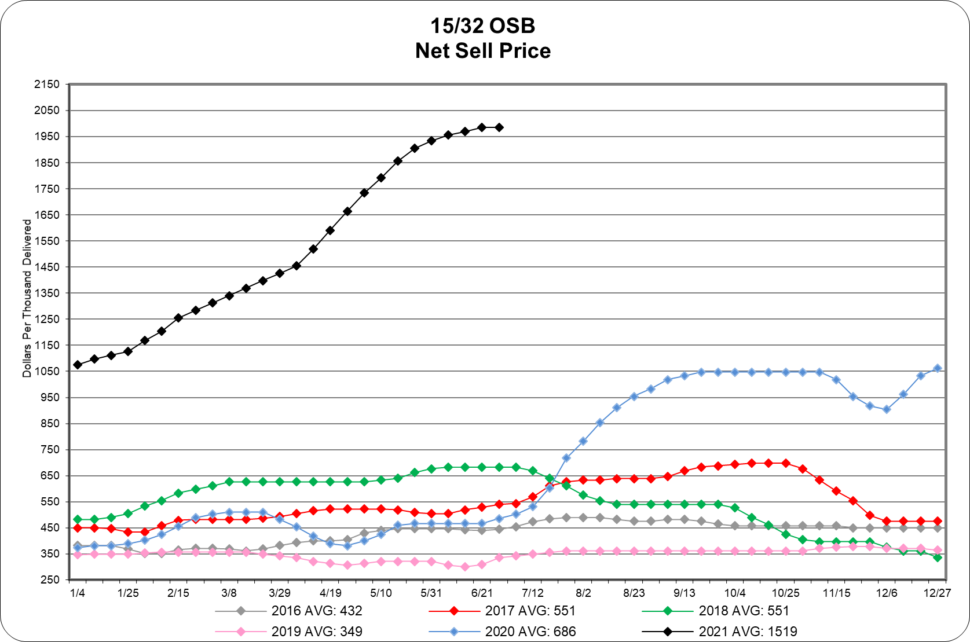

Interestingly, pricing for sheet goods continues to be at historic highs. As you can see from the graph below, 15/32 OSB pricing seems to have peaked and availability is improving. One of the key cost variables for panels is resin, which has significantly increased in cost and remains restricted in availability. One might surmise that pricing for sheeting will drop in light of what’s happened to lumber pricing. We’ll see what this month brings.

As you’ll see from the product category update below, price increases continue, and availability is pushed out. In some cases, this is due to raw material cost increases, like resin. Increased costs for manufacturing labor and delivery are also in play. We provide this so you can adapt your project schedules and quotes based on these insights. Please continue to stay in touch with your sales rep on a weekly basis since changes are happening so quickly.

As always, thank you for your partnership and patience as we continue to navigate these challenging times.

CABINETS:

Lead Times & Price Increases:

- Gallery lead times have extended to 15 – 16 weeks.

- Omega / Dynasty lead times have extended to 16 weeks.

- Legacy lead times have extended to 5 – 7 weeks.

- Timberlake lead times have extended to 10 – 14 weeks.

- Quality Cabinets lead times have extended to 9 – 10 weeks.

- Aristokraft lead times have extended to 6 – 8 weeks. They have announced a price increase of 6.5% effective August 9th.

- WOLF Cabinetry lead times have extended to 6 – 8 weeks. Contractor’s Choice Cabinetry will have a 6.5% price increase effective August 9th.

DECKING & ACCESSORIES:

Price Increases: Trex has announced a price increase 8% on all products effective July 1st. The only exception is Enhance Natural, which will increase by only 1% effective July 1st.

MILLWORK:

Price Increases:

- BWI has announced a price increase effective August 23rd on all hollow core & stile and rail doors of 6-14%, solid core doors of 2-10%, and exterior steel & fiberglass of 15-19%.

- Reeb has announced the following price increases effective August 2nd:

- Therma-Tru – 9%

- Exterior wood doors – 3%

- HB&G will increase 10% with the following exceptions:

- PermaPost – 15%

- Aluminum – 25%

- PermaSnap & PermaWrap – 25%

- Wood columns – 25%

- All other wood products – 25%

- Huttig / BenBilt has announced a 7.5% increase on Therma-Tru doors effective July 31st.

WINDOWS & DOORS:

Lead Time & Price Increases:

- Andersen Window lead times on 100 Series is at 10 weeks, 200 Series is at 3 weeks, 400 Series is at 3 weeks, and A-Series is at 5 weeks. Patio door lead times on 100 Series is at 7 weeks, 200 Series is at 4-6 weeks, and folding doors are at 13-14 weeks.

- Marvin Doors and Windows lead times on Elevate Collection is at 10 weeks, Essential Collection is at 9 weeks, Signature Collection is 23 weeks.

- Ply Gem continues to have extended lead times. 1500 Series Single Hung are 33 weeks, and the Pro Classic Double Hung are 8 weeks. They have announced a 15% price increase effective July 31st.

- Simonton’s lead times are 14 weeks on new construction series and 10 weeks on replacement series.

- Silver Line lead times are 6-9 weeks on single hung and 3 weeks on double hung.

- Atrium lead times are 6 weeks on new construction double hung, 11 weeks on new construction single hung 150/160 Series, and 30 weeks on SH 130 Series.

- 7-D Windows lead times have reduced to 3 weeks. Contact your sales rep if should these lead times enable a quick turn project.

- Velux has announced a 4% price increase effective July 5th.

GARAGE DOORS:

Lead times are 10+ weeks depending on style and color selection. Special orders are out 12-16 weeks.

LUMBER:

As we discussed above, the crumbling of this historic price run has been in full force over the past several weeks. The market is struggling to find a bottom causing confusion and generating uncertainty in this very volatile market. Price fatigue would be a good way to describe the whole of the lumber market over the past few months. We are looking for more of what we previously called ”normal”.

PANELS:

Unlike lumber, the panel market has remained steady and strong. 7/16″ OSB has become more readily available, while flooring and other specialty items continue to be hard to source. Yellow pine plywood and fir plywood are remaining relatively flat, week over week, with yellow pine pricing decreasing due to imported plywood inventory sitting at the port.

INSULATION:

Knauf Insulation has announced an 8% price increase for June 30th. Insulation continues to be on allocation and supply issues will more than likely continued into the fall.

ROOFING:

Lead Times & Price Increases:

- GAF’s price increase of 4-6% increase was put into effective on June 14th. Supply and color availability continue to be very limited. They have also announced several discontinuations:

- TAMKO – Myers has the full line of 13 colors of TAMKO Heritage shingles in stock and we are expanding our TAMKO Titan XT line from 6 to 10 colors. TAMKO announced a price increase of $.50 sq on Heritage and a $1.00 increase on TAMKO Titan XT shingles. We are experiencing extended lead times on coil stock, roof edges, and flashings by as much as 12 weeks.

- Central State Roofing has been experiencing shortages in metal products & extended lead times on some orders. Check with your rep for current lead times.

- Lomanco has announced at 9% price increase effective July 15th.

SIDING:

CertainTeed has suspended the availability of some dark colors in their normal offering. Check with your Myers salesperson for clarification on the availability of your color selection.

All CertainTeed products are on allocation, and we are experiencing extended lead times. We are currently out to June 29th with orders.

LP EWP:

LP’s third quarter price increase is now in effect. They continue to be on allocation causing some extended lead times. Orders should be placed 3-4 weeks ahead of delivery to ensure that all needs can be met. Keep in contact with your salesperson for up-to-date information.

HARDWARE:

Price Increases: Steel prices have gone up over 50% recently and many manufacturers of fasteners have experienced extended lead times.

- Simpson Strong-Tie has announced a price increase of 5-15% effective August 16th.